Hakuhodo India presents Emerging Trends

Hakuhodo India recently held its first Sei-katsu-sha Forum, announcing findings from surveys and research into the attitudes and behaviour of Indian sei-katsu-sha—Hakuhodo’s term for the holistic person—as well as implications for marketing. The study, titled “Emerging Aspirations: Hakuhodo India Trends 2025,” revealed that 89% of Indians feel happy and optimistic, placing India at the top as the happiest nation among the nine Asian countries surveyed. The findings offer a window into the evolving Indian mindset, reflecting a dynamic balance between progressive change and enduring traditional values.

Built on the foundation of robust Hakuhodo Global proprietary research across 9 countries in Asia, the study brings together qualitative research, quantitative home visits, expert viewpoints, and societal trends to present a people (sei-katsu-sha) first, category agnostic reflection of our urban society. Over 10,000 India-specific data points reveal that when much of the world is pessimistic, India remains both financially and emotionally optimistic about the future.

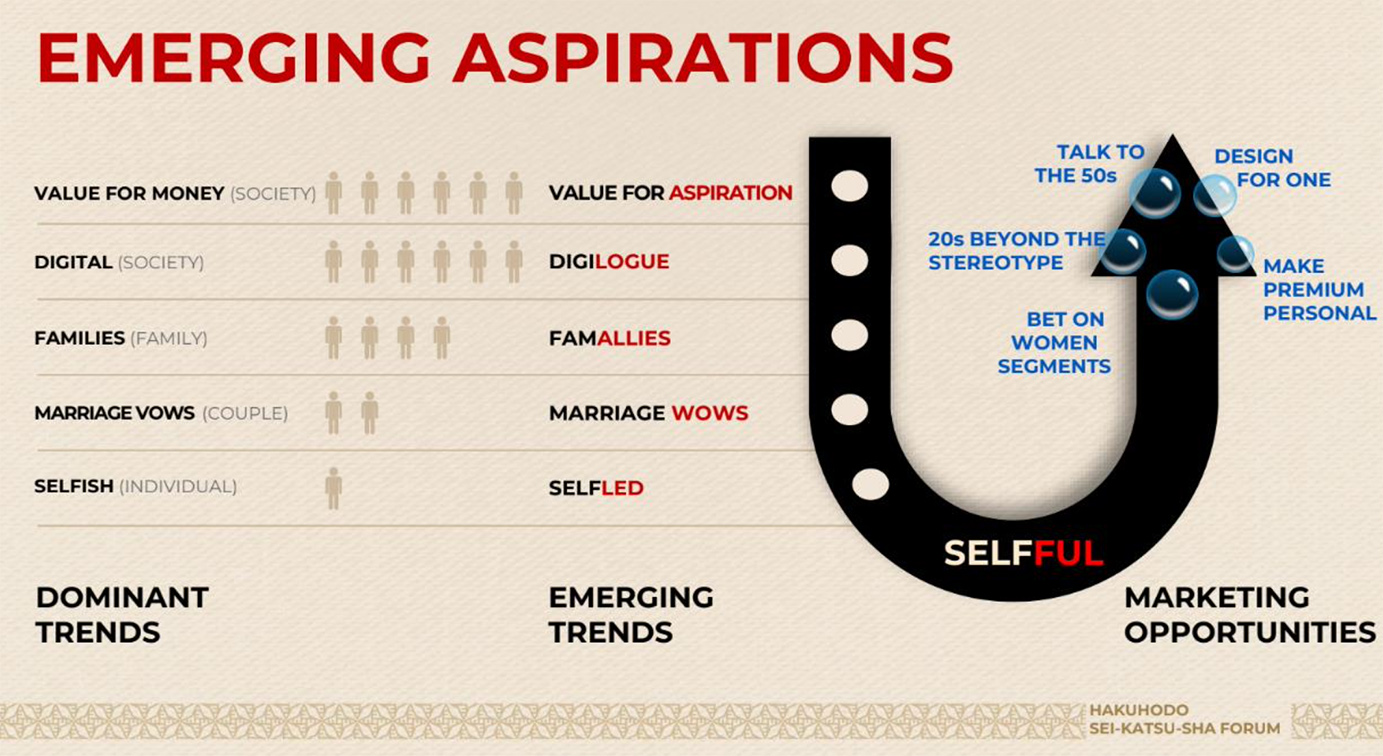

The keys trends and the findings are as follows:

Value for Money vs Value for Aspiration

Indians are making a marked shift from being value-for-money seekers to aspirational consumers. 44% now prefer superior products even at higher prices, linking purchases to happiness, excitement, and indulgence rather than pure utility. This aspirational trend isn’t restricted to young consumers—41% of those in their 50s are eager to try new products, 1.6 times higher than those in the wider ASEAN region. From rising participation in live events and impulse spending to the popularity of pre-owned luxury, Indians are increasingly optimising for experiences over stability.

Digital to Digilogue

While 88% of Indians embrace AI in everyday life—at least 10 points above any other surveyed country—they continue to value genuine offline connections. Indians are 2.5 times more eager for face-to-face meetings than the people of Japan and 33% still feel uneasy without reading a newspaper in the morning. The 50s demographic is surprisingly digitally agile—7 times more engaged on social media than Japan’s 50s—yet the youngest Indians are pulling back from digital pressure and seeking mental balance. Indians are behaviourally digital but emotionally analogue, craving touch and trust amidst tech-driven lives.

Families to FamAllies

Personal relationships at home are a major stress point for 42% of Indians, the highest across markets surveyed. As a result, Indians are preferring friends over family: 61% Indians—1.2 times the ASEAN average— find having reliable friends as point of satisfaction, and 49% consult friends on major life decisions. Indians are friend-zoning all relationships be it between parents and children or between couples. 30% of couples are seeking friendship in romantic partnerships.

Marriage Vows to Marriage Wows

Love is still central, with Indians ranking it as their top aspiration, but the idea that love must end in marriage is fading. 48% believe love and marriage are different—2.3 times more than in China. There’s also new acceptance of love outside marriage. Indians in their 50s are especially reimagining partnerships.Women’s participation on dating and matrimonial apps is also rising, thanks to improved safety features and a focus on authenticity.

Selfish to Selfled

Prioritizing the self is now mainstream in India. 17% want to spend on themselves rather than saving for their children—3.4 times the rate in China. “Mood over money” is the new mantra, with 40% of women desiring more ‘me-time’ and 43% of men wanting to invest more in beauty and self-care—4.8 times higher than Japan.

These findings highlight India’s vibrant optimism and evolving aspirations, offering marketers and brands key insights into a dynamic society where tradition and modernity coexist, and individuals confidently chart their own paths.

Outline of research

Quantitative research

Methodology: Online survey

Survey area: 9 Countries – India (Delhi, Mumbai, Bangalore), Japan, China, Thailand, Vietnam, Indonesia, Singapore, Philippines, Malaysia

Target population: Males and females aged 15-59, 13,000 samples in total with 2000 samples in India

Survey period: Jan 2025

Qualitative research

Methodology: Home visits

Survey area: Delhi, Mumbai, Bangalore

Target population: Males and females aged 20-29 years and 50-59 years, 12 sample size in total and 11 expert interviews.

Survey period: May 2025