MAGNA report finds global advertising market reaches new heights and exceeds pre-COVID levels: APAC ad economy grows by 16.5%

Mediabrands’ global market research company MAGNA has released a new report that finds that media owners’ advertising revenues grew by +22% to a new all-time high of $710 billion in 2021. This follows a decline of -2.5% in 2020. The report details the Asia Pacific advertising economy grew by +16.5% in 2021, following the recession of 2020. In 2022, the Asia Pacific ad market is expected to expand by +11.2%.

The key findings in the MAGNA report are:

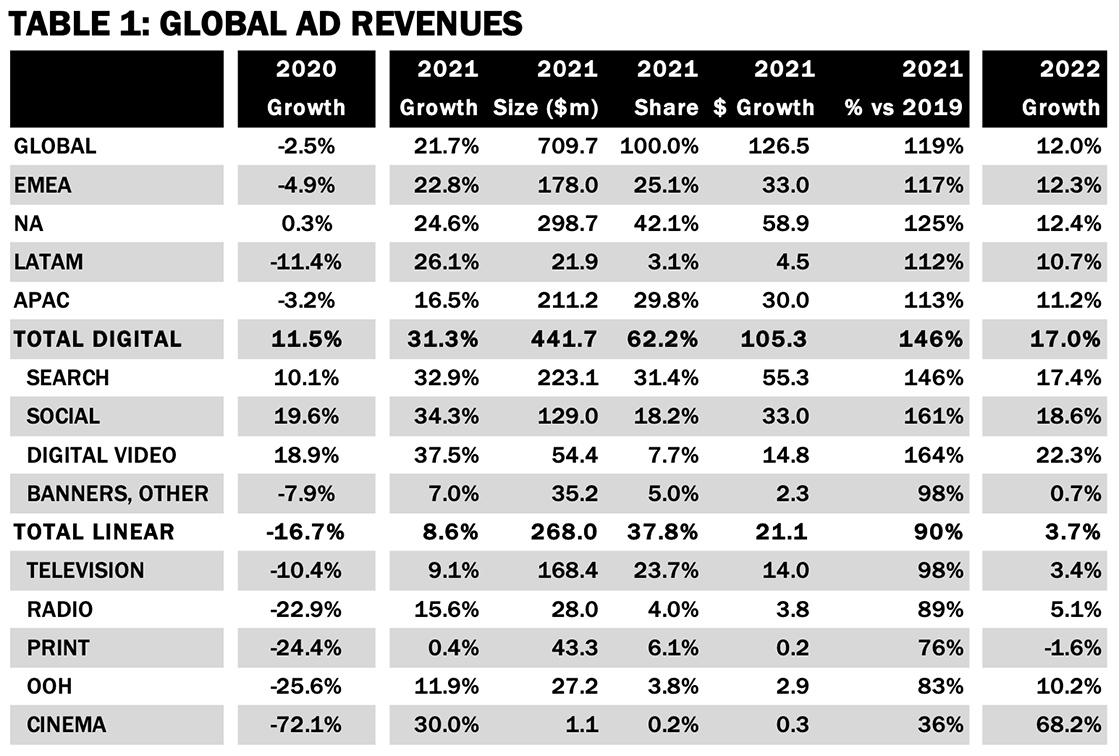

1. Globally, media owners’ advertising revenues grew by +22% in 2021 to reach a new all-time high of $710 billion, following a decline of -2.5% in 2020. Advertisers spent an additional $126 billion on top of the 2020 tally. The global marketplace is now 19% larger than pre-COVID levels and will continue to grow steadily in 2022 (+12%).

2. Advertising revenues from traditional advertising formats (TV, radio, OOH, print, cinema) grew by $21 billion (+9%) following a -17% decline in 2020, to reach $268 billion; this puts traditional formats at 90% of the pre-COVID market size (2019).

3. Digital advertising sales (search, social, video, banners, digital audio) increased by $105 billion (+31%) to reach $442 billion; digital formats now represent 62% of total advertising sales worldwide.

4. Advertising growth is fueled by strong economic recovery (global GDP +5.9%) and personal consumption, as expected, but the magnitude of growth rates suggests it is more than just the marketplace catching up post- COVID and organic growth factors are driving the tremendous digital acceleration of 2021.

5. Among those factors are the growth in digital media consumption and the explosion in e-commerce scale and depth, which prompted big brands and – especially – small businesses to increase digital marketing activity and ramp up their use of social and search formats.

6. All major industry verticals increased ad spend this year. Drinks, Entertainment, Retail and Technology were among the most dynamic spenders, while Automotive ad spend stalled after a strong first half, due to the semiconductor shortage reducing production and sales.

7. Ad spend grew in all 70 ad markets monitored by MAGNA and reached double-digits in 68 out of 70. Several of the world’s largest markets posted above-average growth including the US (+25%), the UK (+34%), Brazil (+30%), Canada (+27%) and Australia (+23%), while China (+17%) and India (+14%) experienced below average growth.

8. Looking at 2022, supply chain issues will slow down some verticals, and tail end of COVID may still inhibit growth in a small number of markets, but growth factors are strong enough for MAGNA to forecast further growth in advertising spending. Economic growth (global GDP +4.9%) and large-scale vaccination will spur consumer mobility and the recovery of some laggard verticals (Travel, Movies), while digital growth will continue to grow organically, and no less than three cyclical events (Winter Olympics, US Mid-Term elections and FIFA World Cup) will bring billions of incremental marketing budgets.

9. In this environment, the global marketplace will grow by +12% to reach $795 billion. Linear ad format growth will slow down to +4% (still a stronger performance than the pre-COVID trends) while digital ad formats will grow by +17%.

10. The Asia Pacific advertising economy grew by +16.5% in 2021, a significant acceleration from 2020’s COVID- impacted -0.8%. Growth is powered by large markets such as China (+16.7% in 2021, +8.0% expected in 2022), and India (+14.0% in 2021, +14.5% expected in 2022). In 2022, APAC advertising revenues will increase by +11.2% to $235 billion, 25% above the pre-COVID spending level, driven by digital advertising growth (+16.2%).

Vincent Létang, EVP, Global Market Research at MAGNA and author of the report, said: “The global ad market recovered above and beyond the economic recovery in 2021. Mature linear ad formats recovered to 90% of the pre-COVID level, just as the economy did. Digital ad formats, by contrast, grew much faster than expected, driven by multiple organic growth factors, e-commerce boom being the most significant. Traditional, brand- and privacy-safe media remain crucial to building consumer brands, as shown by the strong demand boosting TV costs in 2021, but marketers are increasingly diversifying into digital formats to reach hard-to-reach audiences, improve ROI and connect more seamlessly to e-commerce. This once-in-a-lifetime planet alignment of growth factors led to the unprecedented market growth we experienced in 2021.”

GLOBAL AD MARKET: +22% TO $710 BILLION

The global economy has recovered in-line with expectations (GDP +5.9% vs +6.4% expected in April) and, in most markets, so has marketing activity and advertising spending. Growth was particularly strong wherever COVID vaccination was fast and deep and allowed full business re-opening early in the year: US +6.0%, UK +6.8%, France +6.3%. Some other large markets displayed tepid economic recovery by comparison, due to underwhelming vaccination and lingering COVID restrictions and/or a manufacturing sector crippled by supply- chain issues: Japan +2.4%, Germany +3.1%. Throughout the world, consumers spent more money than ever in 2021, using the forced savings they built up in 2020 as soon as restrictions to mobility and shopping were relaxed in the spring or summer. In that environment, national brands and local businesses competed to be the first or the most effective in reconnecting with consumers. Ad spend also benefited from the added driver of rescheduled international sports events (Summer Olympics, UEFA Euro).

Global all-media advertising spending grew by almost +22% to reach a new all-time high of $710 billion. This +22% growth represents the highest growth rate ever recorded by MAGNA, beating +12.5% in 2000 and a significant increase from MAGNA’s previous global forecast (June 2021: +14%). Coming after the COVID lockdowns of 2020, and fueled by the gigantic Government stimulus packages, 2021 was always expected to show record growth, but again, this is growth in excess of recovery. The compounded advertising market growth over the two years 2020-21 was +9%, higher than the average growth experienced during the four years before COVID (+6% per year between 2016 and 2019). It shows that, on top of economic recovery and COVID control, several organic factors drove the tremendous acceleration of 2021 (detailed below).

Linear ad format sales (TV and long-form video, radio, print, OOH, cinema) grew by +9% to reach $268 billion worldwide. Regaining $21 billion of the $50 billion lost in 2020 (-17%). Global linear sales are thus back to 90% of pre-COVID (2019) levels. Most of the growth came from demand-driven inflation in media costs, rather than increased volumes, ad loads or impressions. Linear TV CPMs for instance, grew by an average +13% globally due to strong demand from many key industries (Retail, CPG/FMCG) and shrinking supply (linear viewing resumed its long-term decline following the COVID surge in 2020). As a result, TV spending grew by +9% in 2021.

While mature linear ad formats recovered more or less in-line with the economy, digital ad formats proved once again that organic growth factors – beyond simple economic and marketing recovery – are turbocharging adoption and spending. Changes in lifestyles, media consumption, and business models continued to fuel an acceleration in digital marketing from national consumer brands as well as small, local and “direct” advertisers. Digital growth from consumer brands comes partly at the expense of traditional linear channels, but in the case of small businesses (who represent the bulk of search and social ad spend and are growing much faster than big brands), it is almost entirely incremental money being added to the advertising pie. Digital advertising formats (search, social, video, banners, digital audio) grew by +31% to reach $442 billion or 146% of the pre-COVID market size. Digital ad formats now account for 62% of total advertising sales worldwide. All digital ad formats grew by double- digits in 2021, led by digital video formats (long and short form) +37%, social media +34% and search +33%. Pricing was also a key component to spending growth in 2021. Supply increased too as digital video and social media continue to grow in reach and time spent, but this still was not enough to meet exploding demand, which led to double-digit inflation in CPM or CPC costs.

Back to traditional ad formats, TV did well in 2021, with global ad sales reaching 168 million (+9% and 98% of the pre-COVID level) but radio was even stronger, although it had more ground to make up: +16% to 28 billion (89% of 2019 sales). Print ad sales were flat around 43 billion but when adding back the digital ad sales of news and magazine publishers, total print-related ad sales were up approx. +10%. Finally, out-of-home media sales grew by +12% to $27 billion. The slower and more gradual recovery of OOH was expected due to the declines in consumer mobility, particularly in the heavily advertised transit segment, hurting OOH media audience and reach for most of 2021. OOH global ad sales stand at just 83% of their pre-COVID level at the end of 2021, but MAGNA is confident that ad sales will increase by double-digits again in 2022 and grow back to the 2019 level by 2023.

In 2021, all seventy ad markets analyzed by MAGNA recovered to some degree. Sixty-eight out of 70 markets reached double-digit growth. Several of the worlds’ largest markets posted above-average growth including the US (+25%), the UK (+34%), Brazil (+30%), Canada (+27%) and Australia (+23%) while China (+17%) and India (+14%) grew below average. Growth was above average in EMEA (+23%), North America (+25%) and LATAM (+26%, partly driven by economic inflation).

Looking forward to 2022, there are two potential threats to the global economy and the advertising marketplace: COVID and supply chain issues. Turning first to COVID, the recent increase in cases and endless controversies about vaccination and passes should not hide the good news that the war against COVID is nearly won thanks to vaccination. Cases have increased again in 4Q21 to reach 500,000 daily worldwide by mid-November, but that remains well below the previous peaks of 800,000 cases per day and, more importantly, the number of deaths remains relatively low (7,000 daily). That is because 4.2 billion people have already received at least one dose of vaccine, representing more than half the world’s population (60% to 80% in most Western countries). Beyond some renewed mobility restrictions promulgated e.g. in Austria, Netherlands and Germany, most Government policies are prioritizing booster shots, encouraging or even mandating vaccination (Austria from Feb. 2022) rather than bringing back strict restrictions to circulation and business that hurt the economy. We are therefore optimistic that 2022, if not entirely COVID-free, will at least be exempt from the radical policy responses that caused the economy to fall in 2020 and kept it subdued for the early part of 2021.

The second risk lies with supply-chain issues, including the insufficient supply of semi-conductors causing some industries, most notably automotive, to cut production, as well as the insufficient capacity in global shipping and raw materials. We believe the latter issues will self-adjust gradually throughout 2022 as demand cools down and capacities recover, but there is uncertainty about how long the semiconductor shortage will affect the automotive and technology industries. We have factored this in as a headwind for media types that rely particularly on the automotive vertical, for instance local television in the US.

These risks and headwinds are largely offset, in our view, by the drivers on the horizon: strong economic growth (the IMF predicts +4.9%), further mobility recovery (esp. for transit), continued organic digital growth fueled by e- commerce, and no less than three cyclical events generating incremental advertising spending (Winter Olympics, US Mid-Term elections and FIFA World Cup). MAGNA thus predicts the global advertising market to grow by +12% and reach $795 billion in 2022. Linear ad format growth will moderate to +4% (still a stronger performance than pre-COVID) while digital ad formats will grow by +17% and reach 65% of total ad sales.

Next Global Ad Spend update: June 2022

APAC OVERVIEW

The Asia Pacific advertising economy grew by +16.5% in 2021, following the recession of 2020 (-0.8%). In 2022, the Asia Pacific ad market will expand by +11.2%, close to the global average of +12% and in line with the pre- COVID long-term regional growth. Growth is powered by large markets such as China (+16.7% in 2021, +8.0% expected in 2022), and India (+14.0% in 2021, +14.5% expected in 2022). In 2022, APAC advertising revenues will increase by +11.2% to $235 billion, 25% above the pre-COVID spending level, driven by digital advertising growth (+16.2%).

The experience of Asia Pacific with COVID throughout 2021 has been mixed. China has managed to keep cases almost at zero, while India saw a huge outbreak in the Spring and Summer, culminating above 400,000 cases per day at the peak. In addition, Japan, which had escaped unscathed throughout much of 2020, also saw a big spike in the summer to more than 20,000 cases per day. As a result, while the economic recovery has been robust in Asia Pacific, uncertainty remains as to whether the crisis is fully over or whether it will still see case rises and falls throughout 2022. Vaccine rollouts are also mixed. China and Japan have vaccinated three quarters or more of their population, whereas India’s vaccination rate is below 30% of the population and increasingly only slowly. Furthermore, many countries in Southeast Asia suffered their worst outbreaks in the last few months (Thailand, Philippines, Vietnam, Indonesia), which may cause brands to pull back on marketing activity.

On the other hand the experience of COVID and a home-centric lifestyle have changed the consumer behavior towards more streaming, more Ecommerce, and more integration of digital platforms into day-to-day lives, driving digital advertising spending. As a result, APAC’s total advertising spending grew by +16.5% in 2021 and will increase by +11.2% in 2022 to reach $235 billion. This will be significantly ahead of 2019’s pre-COVID total of $187bn.

Linear advertising spending (Linear TV, Print, Radio, OOH) grew by +6.5% in 2021 in APAC. In 2022, media owners’ linear advertising revenues will increase by a meagre +2.7% to represent 34% of total advertiser budgets. The growth of linear format spending in 2021 and 2022 will not come close to offsetting the huge declines in 2020. At the end of 2022, linear advertising revenues will still be just 88% of the pre-COVID total. In fact, despite the bounce-back in spend observed in 2021 and expected in 2022, linear advertising revenues remain on a long-term declining trajectory. For that reason, linear advertising revenues may never again reach the pre-COVID total of $90bn in APAC. By 2026, linear advertising revenues will represent just 25% of total advertiser budgets.

Digital advertising spending, on the other hand, continue to grow, and have even accelerated since COVID. Digital advertiser revenues grew by +23% in 2021, and will grow by +16% in 2022, to represent two thirds of total advertiser budgets. This is up from just 52% of total budgets pre-COVID in 2019. This is also higher than pre- COVID expectations, as consumer behavior changes during the COVID crisis and that are expected to persist into 2022 and beyond are positive for digital advertising spending trajectories. Increased Ecommerce spending, and increased video streaming, will both result in a higher share of attention and therefore ad revenues going to digital formats than pre-COVID.

The APAC advertising market is concentrated around the two largest markets China and Japan, combining to represent 70% of total regional ad spend and ad revenues. This has decreased slightly over the past year because China’s growth in 2021 has been slower than most APAC markets. This is due to a combination of factors including a difficult comparison in 2020 (China was one of the few markets that still grew spending in 2020), as well as a government crackdown on digital media owners which has crimped overall advertising revenue growth in digital formats. In 2022, the strongest growth in APAC will come from India (+15%), the Philippines (+14%), China (+13%), and Malaysia (+12%). The weakest growth, on the other hand, will come from Thailand (+3%), Vietnam (+6%), and Hong Kong (+8%), some of which are still struggling with their worst COVID outbreaks of the crisis.

In APAC (like everywhere else) digital advertising is powering total market growth. Digital advertising revenues increased by +23% in 2021, and will increase by +16% in 2022 to represent 66% of total advertiser budgets. In 2021, growth primarily came from mobile advertising campaigns (+28% to nearly 80% of total digital budgets). By format, 2021’s growth came from search (+23%), video (+30%), and social (+27%). In 2022, mobile advertising spending will again grow rapidly (+19% to 82% of total digital budgets), as will search 17%), video (+19%), and social media (+18%). Smartphones are not just the dominant way that most consumers access the internet; in many APAC markets they are the only way most consumers access the internet. Because GDP per capita has only increased lately, many consumers skipped the desktop hardware generation and conduct their digital lives solely on their smartphones. Furthermore, in China, smartphones are more integrated into consumer lives than they are in almost every other market. Consumers regularly conduct not just their shopping and communications, but also their banking, insurance, and many work functions on their smartphones. By 2026, mobile advertising spending in APAC will represent 88% of total digital budgets.

In APAC, like in most global regions, lower funnel direct digital ad formats continue to perform better than upper funnel brand advertising-related formats. During COVID this was true because of the need to engage with consumers through Ecommerce. Following the crisis, these trends hold because digital consumption is even further integrated into consumer lives. Compared to pre-COVID totals, spending in 2022 on search (162% of pre- COVID total), and social (181% of pre-COVID total) will both be significantly higher than their pre-crisis counterparts. Banner display advertising, on the other hand (flat vs. pre-COVID total), will be struggling on a relative basis.

Television advertising spending grew by +8.3% in 2021 to reach $51.3bn, and it will increase by +1.9% in 2022 to reach 22% of total advertiser budgets. While this is the first growth year for television advertising since 2018, it does not come close to offsetting the declines during the COVID crisis. By 2022, television spending will represent just 94% of the 2019 pre-COVID total. Furthermore, linear television budgets will continue to shrink, and by 2026, they will represent just 17% of total advertising budgets in APAC. TV spending may get a small boost in 2022 because of the Winter Olympics in Beijing. However, this is only stabilizing budgets in 2022; television spending will resume its long-term decline starting in 2023 (-1.7%) as consumer attention shifts away from linear television to digital media formats.

Print ad sales continued to shrink in 2021 (-2.8%), and will be flat in 2022 (+0%), representing just 4% of total advertiser budgets. Furthermore, spending on print will represent just 70% of the pre-COVID total in 2019 by the end of 2022. Print represents such a small portion of total spending, however (just 4% in APAC) that these declines do not have a huge impact on total regional growth. Many verticals or brands that might consider deeper print cuts have already cut print formats entirely from their media plans.

Radio ad sales will increase by +1.7% in 2022 to reach $4.6 billion, following 2021’s -0.8% stagnation. COVID has eroded the importance of radio in media plans because of fewer hours spent driving. As a result, radio will continue to decline slightly through 2026, shrinking to just under 2% of total budgets.

Out of home advertising grew by +9.6% in 2021, and will grow by +7.9% in 2022 and represent 5% of total budgets. This will bring OOH spending back to 93% of the pre-COVID total. Cinema, however, fell significantly during COVID, and only recovered by +23% in 2021. Growth will be +30% in 2022, but that will only return cinema spending to about half of its pre-COVID total. Recovery has been further delayed by many of the additional COVID outbreaks seen in recent months in APAC.

One industry vertical that has been particularly hard-hit recently is the automotive vertical. COVID issues, combined with supply chain challenges particularly the shortage of semiconductor chips, has resulted in both decreased demand and lately significantly lower than usual production. APAC has one of the largest exposures to the auto vertical (9% of total ad spend pre-COVID). This is particularly strong in digital advertising, where automotive represents 14% of total ad spending. As a result, this will be a headwind to growth until automotive supply chain issues ease in the back half of 2022.

Leigh Terry, CEO Mediabrands APAC, said: “As the pandemic continues to impact consumer lifestyle options and choices across many markets, it comes as no surprise that accelerated digital ad revenues continue to take share, growing by +23% in 2021, with a predicted +16% in 2022. However we can see that APAC consumption is even more significantly skewed towards Ecommerce than it is in mature western markets. Giants like Alibaba, JD.com, Rakuten, and Pinduoduo, have grown to the point where shopping online is just as large as shopping in person, while ecommerce sales account for an average market share of 20% of total retail sales in the West.”

CHINA

KEY FINDINGS

• Chinese media owners advertising revenues grew by +16.7% in 2021, the strongest performance since 2011. This will bring the total market size to CNY 675 billion ($98 billion), the second largest market globally behind only the United States.

• Chinese GDP will increase by +8.0% on a real basis, up from 2020’s +2.3% performance (which at the time represented the worst growth in decades).

• Digital ad formats saw spending grow by +20% to reach CNY 508 billion ($74 billion). This represents a huge 75% of total advertising budgets.

• Linear advertising formats grew by +7.1% in 2021, following 2020’s -19.4% performance. This regains some of the lost spending from the COVID crisis, but linear advertising revenues remain just 86% of the pre-COVID total.

Chinese media owners advertising revenues grew by +16.7% in 2021, the strongest performance since 2011.

This will bring the total ad market size to CNY 675 billion ($98 billion), as China remains the second largest market globally behind the United States. This is extremely impressive considering that China was also one of the most resilient markets in 2020 during the COVID crisis, and one of the few to still grow advertising revenues during that year (+2.6%), but it is below global growth (+22%) for the first time ever. This is mostly because Chinese digital media owners have been struggling to grow revenues at the same rate as their global counterparts in 2021 due to new government regulations.

China was the first market exposed to COVID, but ultimately has been very successful in combatting the virus. China and its zero COVID policy has been successful at keeping any small COVID outbreaks contained. Throughout 2021, cases have not gone above 150 per day. Furthermore, many adults are vaccinated with home- grown vaccines. As a result, consumer behavior has quickly returned to normal in China (compared to elsewhere in APAC and in Europe where new outbreaks or new controls are crimping regular spending habits). It also does not hurt that Ecommerce is so tightly integrated into Chinese society, and that digital advertising spending already represented a huge portion of total budgets.

In 2021, Chinese GDP will increase by +8.0% on a real basis, up from 2020’s +2.3% performance (which at the time represented the worst growth in decades). In this environment, digital ad formats saw spending grow by +20% to reach CNY 508 billion ($74 billion). This represents a 75% of total advertising budgets, the second highest globally behind only the UK. Most of the growth is driven by advertising spending on mobile ad formats, which increased by +23% to reach CNY 432 billion and represent 85% of total digital ad spending. Mobile devices are far more integrated into day-to-day life in China than they are in many Western markets, with everything from shopping to finances fully enabled on mobile devices.

By format, Search remains, by far, the largest segment, and represents 57% of total digital budgets in China. Search advertising spending will increase by +19% in 2021, driven by both core search engines and Ecommerce platforms. Because in China, the five digital media giants (Alibaba, Tencent, Baidu, Sina, and Sohu) together control more than 75% of total digital advertising revenues, digital growth trends in line with their performance. For search advertising, Alibaba and Baidu are both growing in the mid-teen percentages compared to 2020. This is below prior expectations and reflects the impact of an increasingly significant and far-reaching government crackdown on big tech. The changes include limitations on what data can be collected from consumers and how it can be used, as well as how search and social media algorithms work among other impacts. As a result, Q3 growth for most digital advertising companies in China was the slowest of the year, with single digit growth rates (the lowest since the first quarter of COVID).

Looking forward, MAGNA expects digital advertising to continue to outperform, and even the +20% growth rate from this year – despite the regulatory limitation – is impressive given the maturity, scale and scope of digital advertising in China. However, there is more uncertainty and incremental headwinds for Chinese digital advertising growth compared to expectations earlier in the year. Beyond search advertising, digital growth will be led by social media (+23% to reach 19% of digital budgets), and video (+30% to reach 17% of total digital budgets). Static banners (+3.5%) and other digital (+2%) will be stable following declines in 2020 as they continue to lose share and favor with brands.

Linear advertising formats grew by +7.1% in 2021, following 2020’s -19.4% collapse. This regains some of the lost spending from the COVID crisis, but linear advertising revenues remain 14% smaller than the pre-COVID total. The television market is very concentrated in China, and a combination of cost increases and returning demand resulted in +8.3% growth in 2021 to represent 17% of total advertiser budgets. Looking forward to 2022, there will be a boost in TV spending as a result of the 2022 Winter Olympics hosted in Beijing. However, that may not be enough, especially with the more difficult comparison from 2021, to result in positive full-year growth. In 2022, television advertising revenues will be slightly down (-1.4%) as consumption trends once again result in headwinds for TV spending. Print formats continued their decline (-11% in 2021) and now represent just 1% of total budgets. Like most markets, budgets in China are concentrating around TV and digital spending. Radio advertising shrank by -8% this year. Finally, while cinema grew by a tremendous +287% in 2020, it remains just 60% of the prior pre-COVID spending total.

In 2022, the Chinese market will grow by +12.6% to reach CNY 760bn ($110bn), surpassing $100 billion for the first time. China will be the second ad market – after the US – to pass the $100 billion mark. Digital will drive the growth through the end of our forecast period. By 2026, digital advertising revenues will represent 85% of total brand budgets in China.

AUSTRALIA

KEY FINDINGS

• Australia’s advertising market grew by +23.1% in 2021 to reach AUD 20.3bn ($14.0bn) driven by economic recovery (real GDP +3.9 %).

• Digital advertising spending grew by +28% in 2021 to reach AUD 14.5bn or 71% of total ad spending.

• Linear advertising formats sales rose by +12% to reach AUD 5.9bn, but they are still 11% smaller than the pre-COVID level, following a -21% decline in 2020.

• Looking forward to 2022, Australia’s advertising economy will grow by +10% to reach AUD 22.5bn ($15.5bn), with digital advertising again leading the way (+14%).

Up until the past few months, Australia had been very successful at combatting COVID. As a result, the first half of the year was very strong for ad spending in Australia. From the end of June, Sydney and eventually Melbourne entered extended periods of lockdown. While this did not have the same disastrous effect on ad spending that was seen in 2020, it still caused spending to slow. That doesn’t change the fact that strong demand in 1H and expected in Q4, combined with the easy comparison from 2020, resulted in the strongest advertising economy performance on record.

Australia’s advertising market grew by +23.1% in 2021 to reach AUD 20.3bn ($14.0bn). This reflects a very strong economic growth environment in 2021 (GDP grew by +3.9 % on a real basis). Most of Australia’s population is now vaccinated against COVID (more than 80% of the 16+ population), which is another reason why the surge in COVID cases in recent month has not led to a significant slowdown in ad spending. Mobility is also back to close to normal levels.

In this environment, digital advertising spending grew by +27% in 2021 to reach AUD 14.3bn. This represents 71% of total ad spending, surpassing the 70% level for the first time. This is behind only the United Kingdom, China, Canada, and Sweden, for highest share of digital advertising budgets as a percent of total ad spending. Digital growth in Australia (like in much of the world) was significantly stronger than it has been historically, and significantly stronger than expectations, in 2021. Growth was led by mobile advertising spending, which increased by +37% to AUD 9.8bn. By format, search (+35%), social media (+31%), and video (+26%) led the way. All of these growth rates represent multi-year highs. For social media, that is the highest growth since 2016, and for search advertising, it is the highest growth rate since 2007.

Linear advertising formats grew by +12% this year to reach AUD 5.9bn. This follows 2020’s -21% collapse for linear advertising sales, and means that linear ad formats represent only 89% of the pre-COVID linear ad spending total. However, given that television is expected to continue eroding in 2023 and beyond, and print continues its long decline, linear ad spend will never reach the pre-COVID highs in Australia. Television spending grew by +16% in 2021, the best performance since 2010, and regaining all the lost revenues in 2020. The main driver was pricing, as CPM inflation well above 20% did more than offset the erosion in ratings. In 2022, the Winter Olympics in Beijing as well as the T20 Cricket World Cup (hosted by Australia in October) will provide a slight tailwind to viewing and spending, but television pricing and spending will just stabilize. Erosion will begin again in 2023 as viewing shifts away from television to digital formats.

Other linear formats also recovered nicely this year (radio +14% to AUD 1bn, out of home +22% to AUD 720 million), but print continued to decline (-10% to AUD 750 million). None of the other linear formats regained its pre-COVID total, however. It will take four more years for OOH to grow back to pre-COVID totals (in 2025) and five years for radio (2026).

Looking forward to 2022, Australia’s advertising economy will grow by +10% to reach AUD 22.5bn ($15.5bn), with digital advertising again leading the way (+14%). While this is not nearly as strong as this year in 2021, it represents 2/3 as much incremental digital ad spending. The growth comparison is just more difficult as it is up against the tremendous performance this year in 2021 rather than the extremely weak performance of 2020.

JAPAN

KEY FINDINGS

• Media owners advertising revenues will rise by +10% in 2022 to reach JPY 5.9 trillion ($55 billion) following strong 2021 growth (+15%).

• Linear formats will rise just +4%, in line with 2021, to reach $24 billion (90% of the pre-COVID market size) while digital ad formats grow by +27% in 2021 and +15% in 2022.

• Economic stabilization in 2021 and 2022 (GDP +2.4% and +3.2%) and Tokyo Olympics support the advertising market recovery, despite some negative public sentiment around the Olympics and the ongoing COVID crisis.

Japan remains the third largest ad market in the world and the second largest in APAC, behind China, with $50 billion (JPY 5.3 trillion) net ad revenues in 2021 and $55 billion (JPY 5.6 trillion) expected by the end of 2022. Historically, the Japanese ad market is typically very stable, growing at a reliable +2% to +4% per year. The disruptions and uncertainty caused by COVID, including lockdowns and the postponement of the Tokyo Olympics, however, have led to unusual disruptions and volatility within the ad market: advertising revenues fell by -6% in 2020 and rebounded by +15% in 2021. 2022 will bring further growth, +10%, followed by a return to stability over the next five years.

Digital ad sales will continue to drive market growth, with total digital net advertising revenues anticipated to rise +15% to reach $30.5 billion (JPY 3.3 trillion), 56% market share. Linear net ad revenues will also see some growth, +4%, though will remain well below 2019 levels: $24.4 billion (JPY 2.6 trillion) compared to $26.9 billion (JPY 2.9 trillion) in 2019.

COVID cases remained high through spring and summer 2021, even as the vaccine rolled out beginning in February 2021, ultimately peaking at over 25,000 new cases per day in late August. As of time of writing (November 2021), daily new cases have dropped substantially, to around 2,000 per day, and 77% of the population is fully vaccinated. This is in line with nearby South Korea (78%) and China (77%).

The persistently high number of new cases during spring and summer 2021 led to negative public sentiment around the Tokyo Olympics, which were held in July and August 2021. A poll conducted in May 2021 found that over 80% of respondents felt the Tokyo Olympics should have been postponed again or cancelled altogether. The format of the event was significantly amended to respond to public anxiety, e.g. the number of non-athlete participants was cut by half, athletes families had to stay home and spectators were banned from stadiums, which reduced the interest in the event for viewers and sponsors. State-owned, ad-free NHK was the main broadcaster, but commercial ad-funded networks (Fuji TV, TV Asahi, and Nippon TV) aired specific events.

The net impact of the Olympics on television advertising revenues was relatively minimal overall, as some brands opted not to run creatives tied to the Olympics before and during the event, due to the mixed feelings of the public towards the Games. Still, revenues for the major television networks were up by double-digits in the second quarter of 2021 compared to the second quarter of 2020 but were flat or down compared to 2019.

The Olympics also had a relatively mild impact on OOH advertising, as the games were held during a state of emergency during which people were discouraged from going outside or using public transportation. Additionally, people were barred from entering the areas near the Olympic stadiums. OOH revenues (static and digital) were ultimately up just +3% for the full year, reaching $3.8 billion (JPY 400 billion). Transit mobility was slow to recover in 2021 and was still down -19% in November 2021 compared to the January 2020 baseline, contributing to reduced exposure to advertising. Television fared slightly better, with revenues rising +7% to reach $14.7 billion (JPY 1.6 trillion), around 95% of the pre-COVID total. Radio, cinema, and print continued to lag through 2021. Radio revenues eroded by another -2%, cinema by -4%, and print by -3%. 2022 is expected to bring a recovery for these linear ad formats, in addition to continued growth for television (+4%) and OOH (+5%). Over the long term, however, MAGNA anticipates linear advertising formats will continue to lose share to digital, with total linear revenues eroding by -3% to -5% per year and falling to $20.8 billion (JPY 2.2 trillion) by 2026, a 34% market share.

Japan has historically lagged in terms of digital adoption, due to the ageing population (nearly 30% of the population is over 65) and conservative media consumption patterns. Digital advertising formats drew just 42% of ad dollars in 2019, well below the APAC and global averages of slightly over 50%. In 2020 and 2021, however, the COVID crisis accelerated the shift to digital, with net advertising revenues rising +8% in 2020 and a whopping +27% in 2021 to reach $26.6 billion (JPY 2.8 trillion). Market share reached 56%, still slightly below the APAC (63%) and global (62%) averages. Strong digital growth will continue in 2022: +15% overall, with the strongest growth coming from video (+18%), search (+15%), and social (+15%) while display stagnates (+4%). Search advertising formats draw the largest share of digital ad dollars, 46% expected at the end of 2022, followed by social (29%).

Japan is one of the very few markets where Facebook and Google do not dominate the digital landscape. Instead, the largest reach can be found with Line, a messaging and social app that also offers VOD, music streaming, digital wallet services, and digital comic distribution, among other services. Line has an average of 72 million monthly unique users in Japan, compared to 47 million for Instagram and 34 million for Facebook (Nielsen Mobile Netview). We anticipate that digital consumption will continue to grow over the next five years, accompanied by a corresponding rise in advertising spend. Digital net advertising revenues will reach $39.6 billion by 2026 (JPY 4.2 trillion), a market share of over 65%, with search and social drawing the bulk of ad dollars (74%).

INDIA

KEY FINDINGS

• Economic activity (real GDP) expanded by +9.5% in 2021 and is poised to grow another +8.5% in 2022.

• Indian net ad sales revenue grew +14% in 2021 to reach $8.9 billion and growth is expected to accelerate in 2022, fuelling an advertising revenue increase of +15% (above the APAC average of +11%).

• Net ad revenues across digital formats will rise +19% to reach $3.4 billion in 2022, while linear ad sales will grow by +13% to reach $6.7 billion, 66% market share.

• Despite the +13% growth next year and the +12% growth in 2021, linear ad sales will remain just 87% of pre-COVID levels, while digital ad sales will be nearly 50% above 2019 levels.

India’s economy is poised for a bounce-back after enduring a second wave of COVID infections in Q2 2021. The government relentlessly made efforts to restrict the economic damage with calibrated lockdowns. Government fiscal and health response supported the recovery and the new infections have fallen significantly with vaccination surpassing a billion doses. As of late November 2021, approximately 30% of the population is fully vaccinated and nearly 60% have received at least one dose of the vaccine. Reducing the likelihood of a prolonged pandemic will continue to be a priority and the introduction of production-linked incentives in various sectors like textiles, automobiles, appliances, etc., will boost manufacturing capabilities.

After a -7.3% contraction in 2020, the sharpest ever recorded in India, the IMF in their October 2021 update has predicted real GDP growth of +9.5% in 2021 and +8.5% in 2022. Supply disruptions have dragged manufacturing activity lower, while the release of pent-up demand has taken consumer prices higher. Consumer price inflation accelerated to +5.6% in 2021, though price pressures are expected to subside somewhat in 2022 (+4.9%).

Waning fear of the virus, along with the opening of economic and leisure activities, has given a boost to demand and improved business sentiment. Advertising revenues swung back to a healthy growth rate of +14% in 2021, rising from INR 577 billion ($7.8 billion) to INR 657 billion ($8.9 billion). Digital ad formats grew by +20% (APAC average: +23%) to INR 214 billion ($2.9 billion), while traditional media rose +12%. Though the second COVID wave in Q2 disrupted the growth momentum of the previous quarter, over 60% of the new gains came in H1 2021 thanks to Indian Premier League (IPL) cricket games moving back to the original schedule, and strong growth from print advertising (+12%). Ecommerce, Retail, Durables, Beverages, Pharma, Real estate, Finance, and Education were the most active categories while automobile, government, personal care, and communication brands continued to hold back their spending.

In 2022, Travel & Hospitality will see a resurgence, with the relaxation in travel regulations. The automobile and handset sectors that experienced supply-side issues will bounce back, too, along with the Education, Realty, Retail, and Fashion sectors. Traditionally TV-heavy categories, like FMCG, Personal products, and Food are expected to increase their share of digital advertising.

The pandemic has reinforced agility and persistent digital engagement. This has accelerated the adoption of e- commerce as a channel and social commerce is increasingly getting popular. Advertisers will pursue every shoppable moment to offer “anywhere commerce” to their consumers. With local players in Reliance and Tata e-commerce platforms gaining more traction, the sector will further increase its share of advertising.

Digital adoption accelerated with increased use of devices and streaming services, gaming, and e-sports benefitting. Digital advertising is currently the second-largest segment at 33% market share at the end of 2021, following growth of +19.6%. Social has the highest share within digital (28%), followed by Display (26%), Search (25%), and Video (21%). Growth has come from Neo banks, crypto exchanges, fantasy sports, and online betting & gaming. In 2022, video and social platforms will gain significant advertising share followed by audio and display. Overall, digital advertising revenues are expected to grow +18.5% next year to top INR 250 billion ($3.4 billion).

Despite disruptions in 2Q21 caused by a surge in COVID cases, television performed well in 2021 (+10%) as original content never dried up. In the IPL, one of the marquee properties, matches were paused partway through the season, due to harsh situations posed by the pandemic; however, resuming them in the second half of 2021, along with the International Cricket Council T20 World Cup, helped television revenue growth. The top 10 advertising categories contribute to more than 80% of the revenues. Ecommerce, education, beverages, realty, pharma, and food advertising revenues grew, while government, automobile, personal care, and financial category eroded in 2021. With IPL media rights coming up in 2022, valuation this time is going to be even higher with the increase in the number of teams and the number of matches. With this factor, coupled with a few critical state elections, television is expected to maintain momentum and grow by +11% to reach INR 290 billion ($4 billion) by the end of 2022.

Newspapers have nearly recovered on circulation and advertising volumes, though the market pricing is still soft. In 2021, overall print grew +12% from a low base (2020: -40%), despite the slowdown in business. Growth has come from Retail, Durables, Finance, Real Estate, and Government spending. 2022 growth is expected to be broad-based, with most categories increasing spends and elections in a few large states helping to drive an increase of +14%. With all COVID restrictions lifted, wedding season (which typically begins in October and lasts through March/April) will present another opportunity for print to thrive.

Radio’s recovery started off briskly before stalling due to the second lockdown in 2Q21. The rebound from the July to October 2021 period was far steeper and vertically driven; however, ad rates will take a while to get back on track. Radio is expected to gain back the transit audience listeners lost during the lockdowns. Growth in both listenership and revenue is expected to come from Tier 2 and Tier 3 markets. Overall, radio advertising revenues grew +20% in 2021 to reach $220 million, nearly 70% of the pre-COVID market size. Growth was driven by E-commerce, Food, Pharma, and Retail advertising. Growth of +21% is expected for 2022.

OOH traffic numbers are already reaching pre-COVID levels, with passenger footfall in airports and the metro increasing rapidly. Increased waiting time due to the health check process makes transit assets more attractive for advertisers. While the recovery in revenue will happen in stages and vary on formats, street furniture, billboards, and transit format occupancy rate have all seen an increase. Cinema hall regulations have been relaxed in most states as of the second half of 2021, and the return of big-budget movies supports recovery for multiplexes. OOH (digital & static, not including cinema) revenues rebounded by +17% in 2021 and an acceleration (+20%) is expected in 2022, with revenues reaching 67% of the 2019 pre-COVID market size at the end of the year. Automobile, Real Estate, OTT & Finance are a few categories driving OOH advertising growth.

NOTES ON OTHER MARKETS

SOUTH KOREA

South Korea’s advertising revenues grew by +18.9% in 2021 to reach KRW 13.5 trillion ($11.4bn). This was significantly higher than prior expectations, as both television and digital were stronger than anticipated throughout the year. While Korea was able to keep COVID largely contained throughout 2020, it has suffered its worst outbreak in 2021, with cases approaching 3,000 per day. Despite that, consumers have continued to spend and advertisers have deployed budgets through this phase of the crisis. This is reflected in GDP, which will grow by +4.3% on a real basis, above prior expectations. Part of the reason that consumers have continued regular activity despite the increases in cases, is because Korea has surpassed 70% of the adult population vaccinated against COVID.

In this environment, digital advertising revenues grew by +28.7% to reach KRW 8.6 trillion ($7.3bn). Digital formats represent 63% of total ad budgets. Digital growth is led by mobile device spending, which increased by +36% to represent 72% of total digital budgets. Growth by format was led by video (+29%), social (+33%), and search advertising (+29%). The +29% digital growth rate was the highest since 2012 and represents a resurgence in consumer spending (and therefore brand spending) more than it does a weaker growth comparison. Digital growth was stable through the pandemic in Korea, so there was no weak growth comparison. Furthermore, because of the recovery in online consumer spending, brands have shifted their focus towards performance marketing.

Linear advertising revenues increased by +5% to reach KRW 4.9tn ($4.2bn). This represents a significant turnaround from 2020’s -16% growth rate, but still means that linear advertising in Korea has not nearly regained its pre-COVID high. In fact, in Korea, linear advertising has been shrinking since 2015, and currently represents just 76% of that 2015 linear advertising high. Television grew by +12% and represents 22% of total budgets. This regains nearly all the spending that was lost during the COVID crisis, but television spend will continue its erosion going forward. Print budgets fell by -9%, falling below 10% of total advertisers budgets for the first time, as even the COVID recovery cannot turn fortunes around for print advertising.

Looking forward, advertising spending will increase by +11% in 2022, with linear advertising budgets remaining flat, and digital ad spending growing by +17% to reach two thirds of total budgets. Digital ad spending will continue to gain share, and by 2026, will represent 76% of total budgets in Korea.

INDONESIA

The Indonesian advertising market grew by +16.6% in 2021, to reach IDR 120 trillion ($8.2 billion). GDP in Indonesia is expected to increase by +3.2% on a real basis in 2021, slightly lower than prior expectations. This is because while Indonesia kept COVID largely under control throughout 2020 and the first half of 2021, there was the worst spike starting this past summer, with more than 50,000 cases daily at the peak. Furthermore, only just over 30% of the population in Indonesia is vaccinated, so while cases are under control for now, there is some risk of future surges in caseloads as new variants like Omicron spread in 2022. Despite this additional challenge, ad spending remained strong this year and will continue its strong performance heading into 2022 (+10% growth expected).

In this environment, digital advertising spending grew by +30% to represent nearly half of total budgets. In 2022, digital advertising revenues will increase by +18% and represent 52% of total advertiser budgets, surpassing half of the total for the first time. Digital advertising’s +30% growth in 2021 was the highest since 2017. Digital spending was led by mobile device spending, which increased by +39% and represents 2/3 of total digital advertising budgets. By format, growth in 2021 was led by search (+35%), social media (+35%), and video advertising (+28%). Digital advertising revenues will continue to outperform linear formats, and by 2026 digital spending will represent 61% of total advertiser budgets in Indonesia.

Linear advertising spend grew by +6% in 2021 to reach IDR 61.3tn ($4.2bn). While this was a bounce from 2020’s dismal -19% performance, it still means that linear advertising spending was only 85% of its pre-COVID total this past year in 2021. No format regained the spending it lost during the COVID crisis across linear media formats. Television spending bounced (+7%), but print (-11%) continued to lose budgets. Out of home advertising grew by +42% to regain essentially all the spending it lost during the COVID crisis. Cinema advertising, however, remains significantly below its pre-COVID total, representing just 75% of prior budgets.

THAILAND

Media owners advertising revenues increased by +5.7% in Thailand in 2021 to reach THB 121.0bn ($3.9bn).

This will leave the Thai market below its pre-COVID total of THB 131.3bn. Thailand is one of only three markets globally that has been revised lower since the June update. This is because Thailand has essentially zero COVID cases throughout 2020 and early 2021. However, starting in the late Spring, COVID cases began to spike, with a huge spike beginning in July 2021 up to more than 20,000 cases per day. As a result, budgets have been impacted as brands conservatively hold back spending to ensure they understand the environment in which consumers will be operating. The economy expanded by a weak +1.0% on a real GDP basis, following 2020’s – 6.2% real GDP decline. Furthermore, while vaccinations are increasing in Thailand, still just over 50% of the population is vaccinated. As a result, there is still a window for cases to have a significant impact on consumer behavior. Combined with the persistent reluctance of Western tourists to travel abroad already, this creates significant economic uncertainty and a headwind to advertising spending. Pre-COVID, tourism contributed to 20% of the Thailand economy.

In this environment, linear advertising revenues were flat (+0.4%), and still represent just 82% of their pre-COVID level. Linear advertising budgets represent the majority of spending in Thailand (76% of total budgets), and the delayed recovery from the COVID crisis for linear ad spending creates a significant drag on total market growth going forward. Television ad spend increased by +4% and represent 57% of total advertising spending. This regains some of the spending lost during the extremely weak 2020, but still means that television spending is short of the pre-COVID total. Because spending will continue to erode starting in 2022 and beyond, TV will never reach its all-time high. Print spending is still declining, and fell by -9% in 2021 and represents just 4% of budgets. There are only a few core spending industries that still deploy budgets on print: real estate, finance, autos, and CPG. Finally, OOH spending stabilized, but still fell by -4% in 2021. The new outbreak doesn’t help spending trajectories for OOH formats, although that is slightly offset by more than 70% of the population in Bangkok being vaccinated against COVID (the location where most of the OOH budgets are concentrated).

Digital advertising spending grew by +26% in 2021 and represent 25% of total budgets. Growth was led by mobile device spending, which increased by +32% and represents 75% of total digital spending. By format, growth was led by social (+32%), video (+22%), and search (+31%).

Looking forward to 2022, ad spending will again grow modestly (+2.8%) to reach THB 124.4bn ($4.0bn) as the recovery of tourism may be postponed again by the appearance of new COVID variants like Omicron.

HONG KONG

Advertising sales in Hong Kong will increase by +24% in 2021 to reach HKD 29.7bn ($3.8bn). GDP grew by +6.9% on a real basis in 2021, following 2020’s -6.2% real GDP decline. Many markets in APAC have struggled with new COVID outbreaks in the second half of 2021. Hong Kong, on the other hand, has maintained its COVID cases close to zero for essentially all of 2021. Furthermore, 60% of the population is vaccinated, a figure that continues to increase. For this reason, brands have felt more confident to deploy budgets, assuming that consumers are fully in the post-COVID recovery phase. In this environment, digital advertising revenues increased by +30% and represent 45% of total budgets. This is very strong performance, but only the highest since 2017 (rather than a multi-decade high like in many Western markets). Digital advertising revenues were led by mobile device spending, which increased by +36% and represents 73% of total digital budgets. By format, digital growth was led by social media (+35%), video (+35%), and search advertising (+34%). The digital video landscape in Hong Kong is extremely strong, and represents 43% of total digital spending, one of the highest totals globally.

Linear advertising revenues grew by +20% this year to reach HKD 16.4bn ($2.1bn). This represents 55% of total budgets. In addition, the +20% growth was the best performance for linear advertising formats on record. However, this is primarily driven by the very weak 2020 comparable (-26%) caused by the combination of global COVID recession and local political unrest. In fact, linear ad spending in 2021 only represented 89% of its pre- COVID total despite the impressive growth rate. Television spending grew by +25%, regaining all the spend lost during the COVID crisis. Print similarly bounced by +8% this year, however, that compares to -42% growth in 2020. As a result, despite the bounce, print budgets only represent 63% of their pre-COVID total.

Looking ahead to 2022, Hong Kong advertising spending will grow by +8% to reach HKD 32bn ($4.1bn). The advertising economy will also continue to reflect the new post-COVID normal. Brand marketing changed because of COVID, with higher demands on discounts and bonuses for linear media. Furthermore, there is more ad-hoc planning and last-minute campaign changes in reaction to market changes, and more efforts spent on contingency plans. Finally, not surprisingly, there are stronger Ecommerce and social commerce efforts from advertisers.

MALAYSIA

Media owners advertising revenues in Malaysia increased by +18.2% in 2021 to reach MYR 5.2bn ($1.2bn). The economy grew by +4.2% on a real GDP basis, following 2020’s -6.3% decline. While this is lower than prior expectations, brands spent anyway, especially on digital advertising formats. Malaysia suffered a spike in COVID cases in the summer and fall of 2021, to more than 20k per day. However, with more than 70% of the population now vaccinated, so while this outbreak put a damper on spending, looking forward into 2022, consumer behavior will largely return to normal.

In this environment, linear advertising revenues increased by +4% to MYR 2.1bn. This is only a very small bounce compared to 2020’s tremendous -39% decline in linear advertising spending. Linear budgets remain at just 64% of their pre-COVID levels. Because linear ad spending will stabilize and then erode from here as consumers continue to shift to digital media formats, linear advertising revenues will never again approach their pre-COVID highs. TV spending, which increased by +14%, came closer to offsetting its 2020 COVID losses. TV budgets are now 90% of their pre-COVID total. Finally, while cinema screens were open earlier in the year, they have ceased operation until further notice. These COVID impacts combine to cause advertisers to take a short term and cautious view of deploying budgets. Many brands are even booking TV by the week to ensure they are not caught off guard by a return to quarantine and suffer wasted budgets. Finally, fewer eyeballs on the road means that OOH spending bounced just +18% this year following 2020’s -44% decline.

Digital advertising spending, on the other hand, grew by +30% to reach 60% of total budgets. This was the strongest performance since 2014. Digital advertising spending was led by spending on mobile devices, which increased by +39% and represent 70% of total digital budgets. By format, spending was led by social media (+37%), video advertising (+30%), and search (+30%). Looking forward, digital advertising spending will continue to significantly outperform linear budgets, and by 2026, digital formats will represent 72% of total advertiser budgets.

In 2022, ad spending will grow by +12% to reach MYR 5.9bn ($1.4bn). GDP will continue to grow by mid-single digit percentages, and linear budgets will take another year to stabilize before shifting towards stagnation or decline in 2023 and beyond.

TAIWAN

Advertising sales grew by +17.9% in 2021 to reach TWD 98.8bn ($3.4bn). The Taiwanese economy will grow by +5.9% in 2021 on a real GDP basis, slightly stronger than prior expectations. With the exception of May and June in 2021 where there was a brief COVID spike with up to 600 cases per day, Taiwan has held COVID remarkably under control throughout the crisis. The risk of outbreaks remains for a little bit longer, since only 44% of the population is vaccinated, but vaccination is increasing quickly and should only be an overhang to business and ad spending for the first half of 2022.

In this environment, linear advertising revenues were flat (-0.5%), and represent just 30% of total ad budgets. This remains just 87% of the level of pre-COVID budgets, but because linear ad revenues did not bounce this year in a reasonably normal environment, they will never again reach the pre-COVID high. Television advertising spending grew slightly (+1.4%), but print (-31%) and radio (-19%) continued to suffer. Short term behavior changes while COVID remains a threat, as well as long term consumer habits which have shifted towards online consumption, will be a permanent headwind to these formats. Out of home spending increased by +20%, more than regaining spending lost during COVID.

Digital advertising formats grew by +28% and now represent 71% of total advertising budgets. Digital spending was buoyed by spending on mobile devices, which increased by +31% and represents the majority (83%) of total digital spending. By format, growth was led by search (+29%), social (+35%), and video spending (+19%). Looking forward, digital spending will continue to outperform linear advertising formats, and by 2026 digital formats will represent 83% of total budgets.

PHILIPPINES

Advertising spending in the Philippines will increase by +15.2% in 2021, to reach PHP 125.2bn ($2.5bn). Real GDP increased by +3.3% this year, below prior expectations, as a result of a deterioration in the COVID environment. There was a spike of cases as high as 20,000 per day in August, September, and October. While cases are declining for now, only 1/3 of the population in the Philippines is vaccinated, so there will continue to be a risk of further outbreaks throughout much of 2022. As a result, the Philippines is one of only three markets globally where growth expectations were revised slightly lower vs. the June forecast. However, the +15% ad spending growth in the Philippines still represents regaining all the spending lost during COVID, and is also the strongest growth since 2017.

In this environment, linear advertising revenues increased by +10%. Television budgets increased by +8% to PHP 69bn ($1.4bn). While this is strong performance, it does not fully offset the losses suffered in 2020. Television spending still represents just 94% of the pre-COVID spending total. Print grew by a similar amount (+7%), but this was following a disastrous decline of -50% in 2020. As a result, while spending stabilized, print budgets remain hugely below their pre-COVID total and now represent just 1% of total advertiser budgets. Out of home spending grew by +25%, regaining about half of lost spending during the COVID crisis. Finally, cinema revenues stabilized (+22%), but at a much lower level.

Digital advertising spending grew by +37% in 2021, the best performance since 2014, and now represent nearly one quarter of total budgets. By 2026, digital advertising will represent 43% of total budgets.

SINGAPORE

Singapore’s advertising sales increased by +14.4% in 2021 to reach SGD 2.3bn ($1.7bn). Singapore’s economy increased by +8.6% on a real GDP basis, While Singapore is currently going through their worst COVID outbreak (case spikes to nearly 4,000 per day in November 2021, compared to essentially zero throughout the rest of 2021), the government is transitioning away from crisis mode and back to a semblance of normality. It helps that 88% of the population in Singapore is vaccinated, one of the highest rates in the world. As a result, the government has switched from a ‘zero COVID’ policy to a policy of living with COVID. As a result, consumer behavior has returned to something close to normal, and brands are deploying the dollars they cut in 2020 to take advantage of the new reality.

In this environment, linear advertising revenues increased by +6% and represent 60% of total budgets. This is the best performance for linear advertising revenues since 2010, but is largely driven by the easy comparison from 2020 (-16%). Because of this relatively small bounce, linear advertising revenues will still represent just 88% of their pre-COVID total. In fact, because linear advertising revenues are expected to stabilize and then continue to decline starting in 2023, they will never again reach their pre-COVID total. Television advertising spending grew by +8% in 2021 and represent 31% of total budgets. Out of home format spending grew by +27%, not quite offsetting the losses suffered in 2020 (-30%).

Digital advertising revenues grew by +30%, the strongest performance since 2014, and represent 40% of total advertiser budgets in Singapore. Spending was led by mobile device campaigns, which increased by +35% and represent 78% of total digital budgets. By format, growth was led by search (+37%), social (+33%), and video (+23%). Digital advertising will continue to outperform linear advertising formats, and by 2026 they will represent 60% of total advertiser budgets.

NEW ZEALAND

The advertising economy in New Zealand increased by +18% in 2021 to reach NZD 3.1 billion ($2.0 billion). The economy in New Zealand grew by +7.9% on a real basis in 2021, more than offsetting the declines suffered in 2020 (-3.8%). Furthermore, while New Zealand has been relatively successful at combatting COVID throughout the crisis, it has suffered a small outbreak in recent months (~200 cases per day). 68% of the population in New Zealand is vaccinated against COVID, so there is a window for the outbreak to continue to grow, but thus far brands have shrugged it off and continued to spend aggressively.

In this environment, linear advertising revenues increased by +8.2%. This does not yet offset the declines suffered for linear ad formats during the COVID crisis in 2020, and linear advertising spending this year was just 87% of its pre-COVID total. Television revenues increased by +15%, completely offsetting COVID crisis losses (and the strongest growth for television since 2003). Print continued to shrink (-6%), however, and while out of home spending grew slightly (+5%), it is still just ~68% of its pre-COVID total.

Digital advertising revenues grew by +26% to reach NZD 1.9bn ($1.2bn). Spending was led by campaigns on mobile devices, which grew by +34% and represent 67% of total digital budgets. By format, growth was led by search (+33%), social (+31%), and video (+21%). Looking forward, digital will continue to take share compared to linear advertising formats, and by 2026 digital budgets will represent 72% of total advertising budgets.

VIETNAM

Advertising revenues in Vietnam increased by +3.7% in 2021, slower than prior expectations. This will bring the market to VND 31.4 trillion ($1.4 billion). The economy in Vietnam is expected to increase by +3.8% on a real GDP basis. While Vietnam has been relatively successful at tackling COVID through the first half of 2021, they have suffered an outbreak from June onward to as high as 10,000 cases per day. Furthermore, only one third of the population is vaccinated by November 2021. As a result, there is still room for a significant COVID impact in 2022 if the current outbreak does not come under control. Brands are hesitant about deploying budgets, and that is the reason why they have pulled back and growth was weaker than initial expectations in 2021.

Linear advertising revenues shrank by -5.4% in 2021, with television shrinking by -4%. Linear advertising formats represent 68% of total budgets. Television spending decreased by -4% to 64% of budgets. TV advertising revenues is still a huge portion of overall ad budgets in Vietnam. Digital advertising revenues increased by +30% to reach 32% of total advertiser budgets. Digital spending was led by mobile device campaigns, which increased by +41% and represent 69% of total digital advertising budgets. By format, growth was led by social (+49%), video (+31%), and search (+20%).

PAKISTAN

Pakistan’s economic recovery is expected to continue in 2022, with real GDP forecast to grow by +4% according to the latest IMF report (October 2021) following growth of +3.9% in 2021. A substantial loan from the IMF ($6 billion), supports this recovery, along with improvements in the COVID case rate and a more widespread vaccine rollout. As of November 2021, Pakistan was averaging around 300 new cases per day, down from a peak of nearly 6,000 in April 2021, and 22% of the population was fully vaccinated. The vaccine rollout was initially relatively slow but began to pick up steam over the summer and fall of 2021. 120 million doses have been administered, according to the National Command and Operation Centre.

In this context, linear net advertising revenues are expected to grow by +5% in 2022, a slight slowdown from 2021 growth of +6%, with OOH (+10%) and television (+5%) seeing the strongest growth. Print will continue to stagnate, -1%, while radio will see a modest increase of +4%. Overall, MAGNA anticipates total linear revenues will reach nearly $480 million by the end of 2022, slightly above the pre-COVID total of $460 million.

Digital ad formats will experience much stronger growth, with revenues rising +28% to reach $170 million. This follows strong 2021 growth of +38%, driven by significant increases from digital video (+43%) and search (+41%). Digital (+41%) and search (+29%) will continue to drive growth in 2022, along with social (+23%). Digital media remains relatively underdeveloped in Pakistan, accounting for less than 30% of total ad dollars (APAC average: 63%; India: 33%) but growing rapidly. Over the next five years MAGNA anticipates a digital CAGR of +28%. Over 70% of digital ad dollars currently go towards mobile formats; this share is expected to increase to 86% by 2026.

SRI LANKA

The Sri Lankan advertising market contracted by -9% in 2020 amid the Coronavirus crisis and political and economic turmoil (real GDP: -3.6%) before recovering by +13% in 2021. Further growth of +11% is anticipated for 2022, driven primarily by digital formats (+26%).

The number of daily new COVID cases in Sri Lanka peaked in spring and summer of 2021, reaching a high of nearly 10,000 in August, then began to decline again in the fall. As of late November, 2021, there were approximately 700 new cases per day and a total of nearly 560,000 cases overall, or around 25.5 thousand cases per million people (India: 25.4k, Pakistan: 5.9k). A little over 60% of the population is fully vaccinated and 70% have received at least one dose. Sinopharm and Pfizer are the primary vaccines used in Sri Lanka.

On the macroeconomic side, real GDP is expected to grow by +3.3% in 2022, slightly below the previous IMF forecast (April 2021) of +4.1%. Consumer price inflation will accelerate, up to +6.3% from +5.1% in 2021.

The advertising market will grow by +11% in 2022, a slight slowdown from 2021 (+13%). As we see across APAC, digital is the backbone of growth, with all digital formats expected to see another year of double-digit growth: video +51%, social +26%, search +23%, and display +18%. In total, digital advertising revenues will reach $140 million, or a 36% market share. Linear formats will also see some growth, though on a smaller scale. Television (+5%), radio (+8%), and OOH (+17%) will see the strongest growth, print will decline slightly (-3%). 2023 will bring continued recovery for most linear ad formats, again with the exception of print, but over the long term we anticipate digital will continue to gain market share at the expense of linear media channels.