Dentsu Anime Report: Southeast Asia’s anime fandom fuels brand growth in APAC

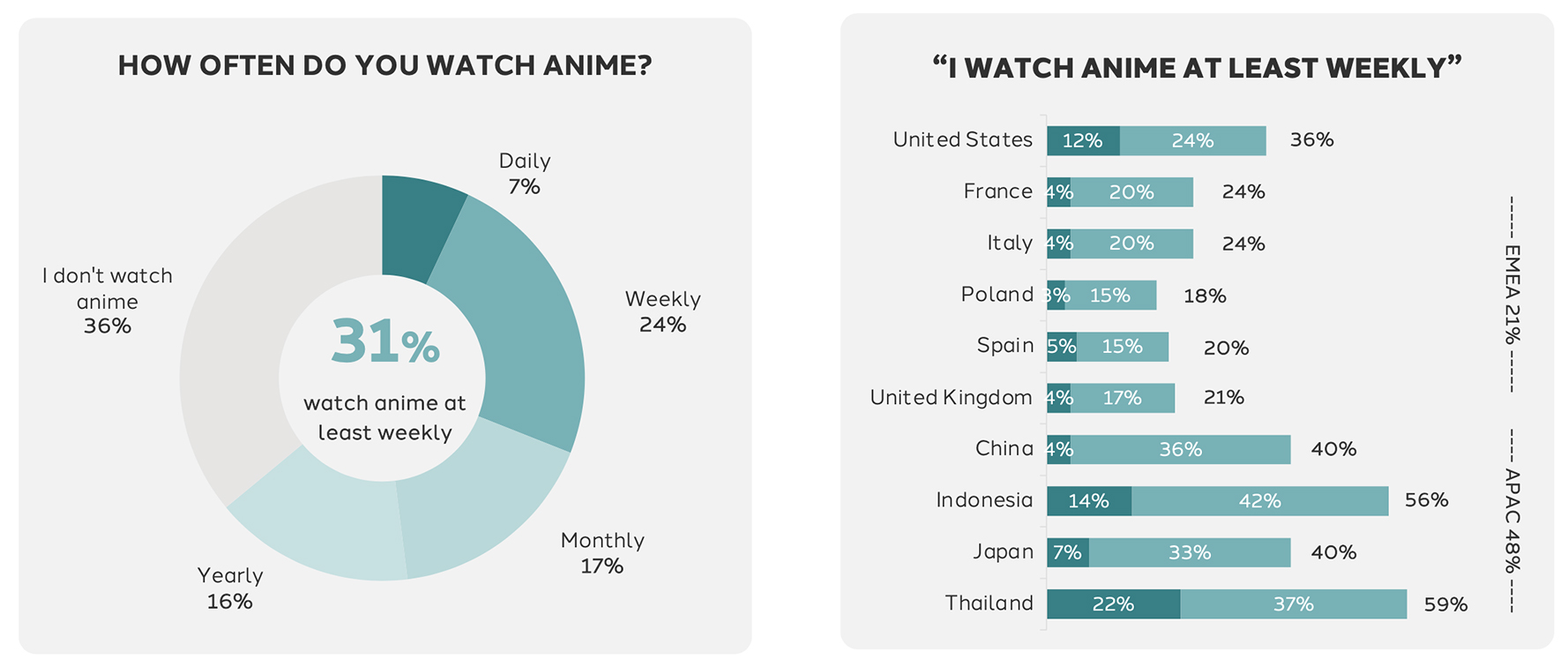

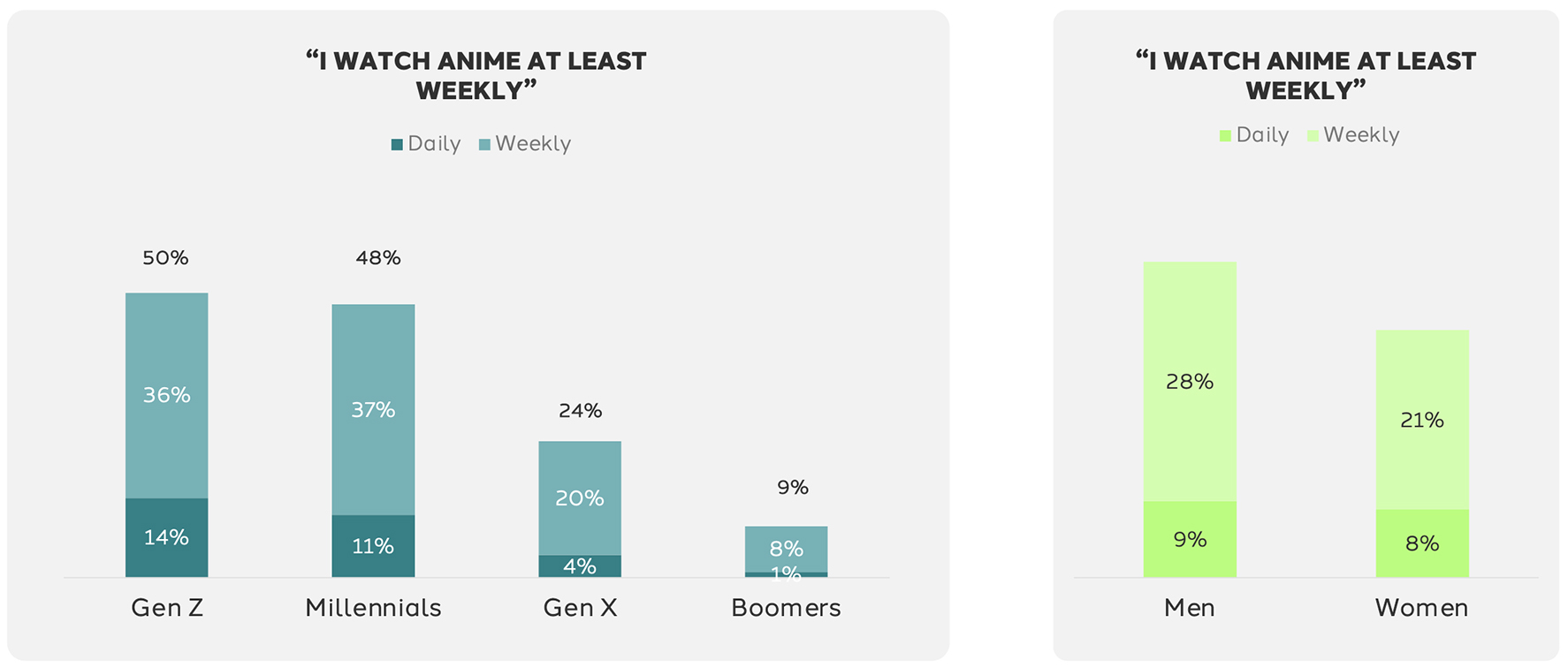

Anime has emerged as a powerful growth engine in Southeast Asia, driven by the region’s young, digital-native consumers and their appetite for immersive, culture-driven content. According to Dentsu’s Global Research Report “Anime: A Growing Opportunity for Brands”, 3 in 10 global consumers now watch anime weekly, with viewership and fan engagement surging across APAC, particularly in Thailand, Indonesia, and other SEA markets, making the region one of the most engaged fandom clusters outside Japan.

Younger audiences in Southeast Asia are not just watching anime—they’re building communities around it, creating their own content, and spending enthusiastically on anime-inspired products. This isn’t just a media preference, it’s a cultural identity.

Three Key Takeaways from dentsu’s Report:

• Mainstream Momentum in SEA. Southeast Asian fans are active participants, not just viewers. From attending conventions to creating and selling anime-inspired designs, the fandom is driven by creativity and community. In Indonesia alone, nearly 1 in 5 Gen Z fans post about anime on social platforms or join related Discord communities.

• Cultural Currency: In markets like Thailand and Indonesia, anime is seen as both an escape and a mirror—offering emotional depth, genre diversity, and a creative counterbalance to Western media.

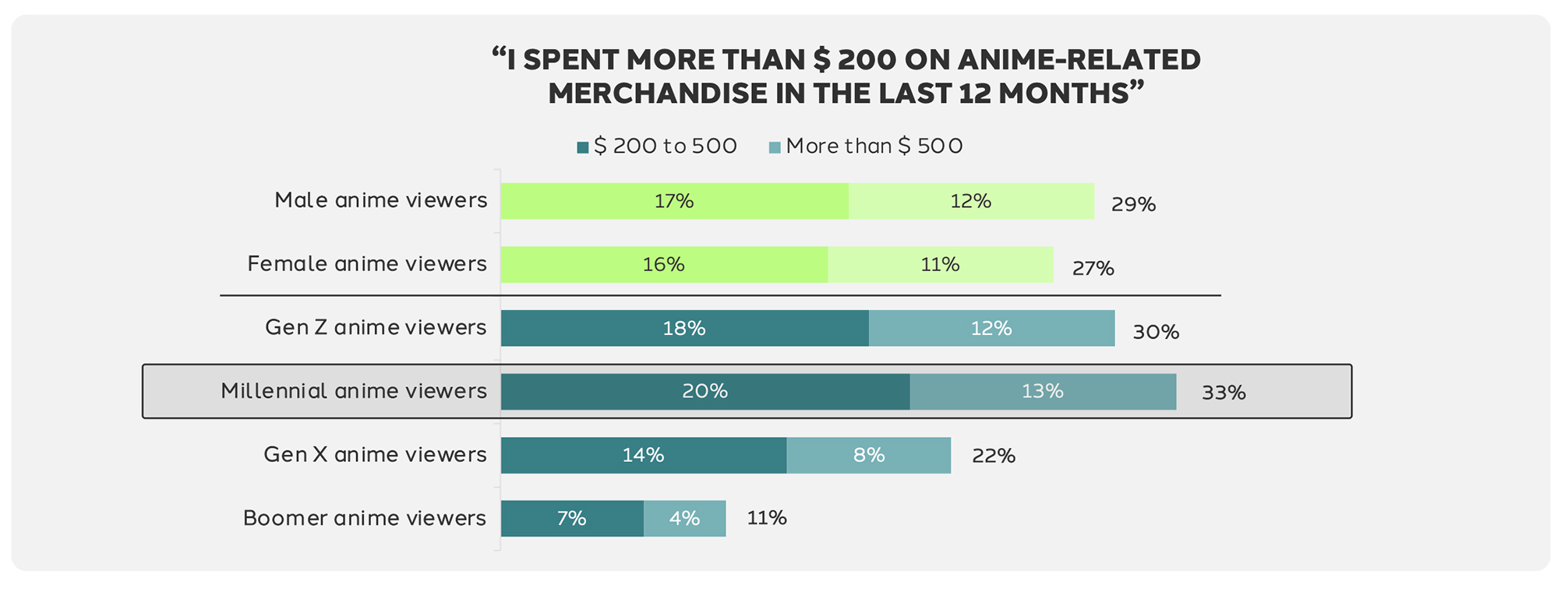

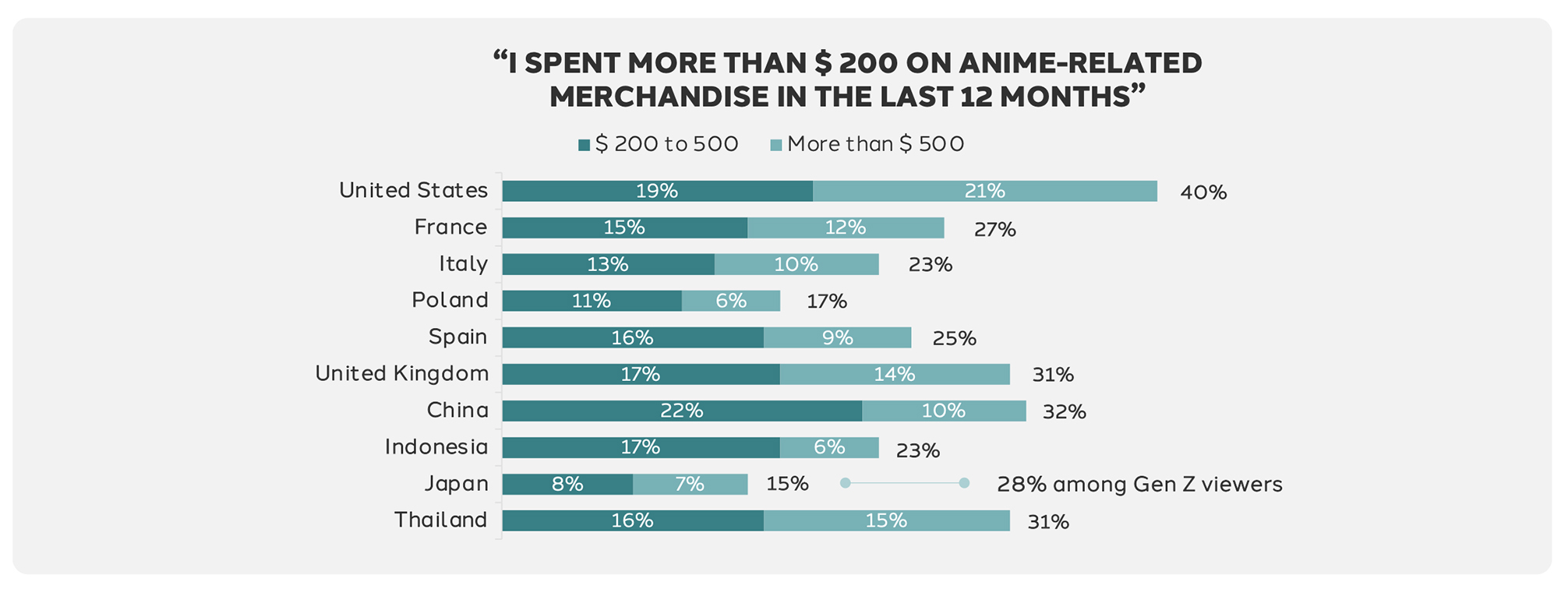

• Fandom as Commerce. Nearly 1 in 3 Thai anime viewers have spent over $200 on anime merchandise in the past year. Gen Z and Millennials in SEA are highly active in anime-related online communities, conventions, and creator platforms.

As anime continues to influence fashion, gaming, wellness, and entertainment experiences, the opportunity is no longer “emerging”—it’s here. Brands in Southeast Asia that understand the emotional and creative fabric of fandom will be best positioned to connect deeply and grow meaningfully.

Part of the Dentsu Consumer Navigator Series, the 2025 Global Research Report, “Anime: A Growing Opportunity for Brands”, reflect the data collected over the course of three research efforts in the US, in the EMEA region, and in the APAC region between October 2024 and March 2025, which surveyed 2,000 consumers in the UK; 1,000 consumers in the US; and 700 consumers, respectively, in China, France, Indonesia, Italy, Japan, Poland, Spain, and Thailand.