Magna report: The Asia Pacific advertising economy will grow by +8% this year

The Asia Pacific advertising economy will grow by +8% this year, following the 2021 rebound (+18%) says Magna Global Advertising Forecast for June.

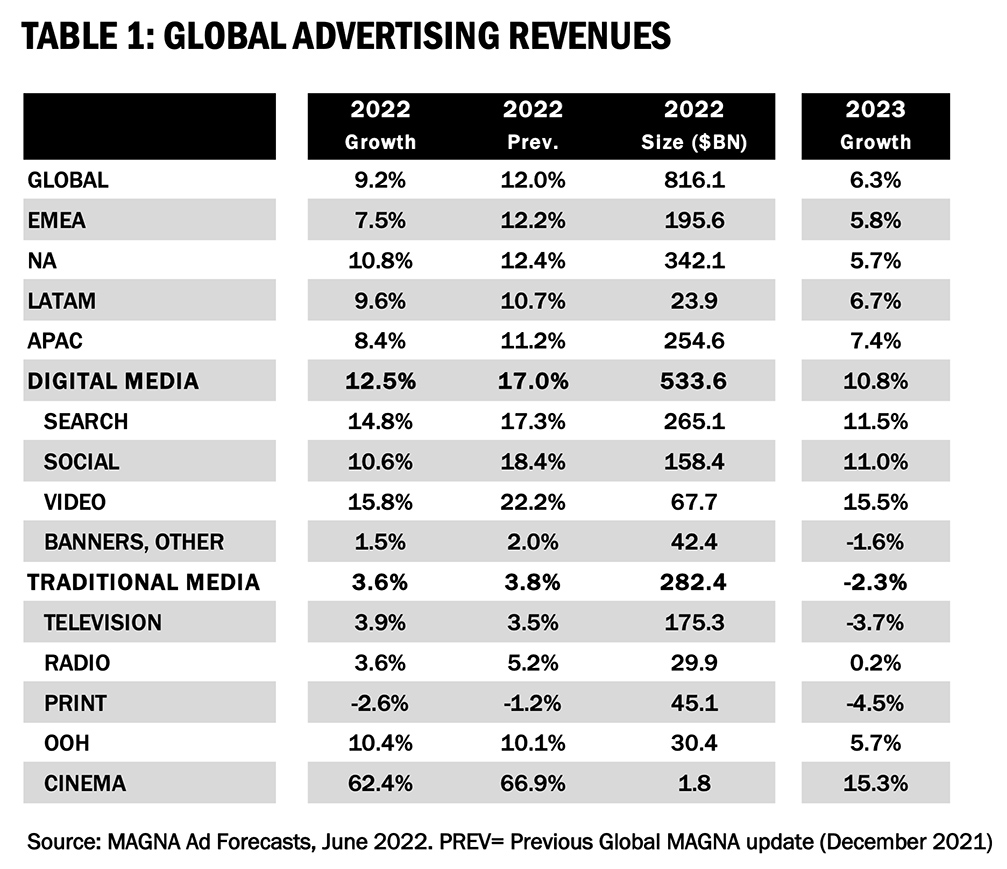

GLOBAL FORECAST: +9.2%

Globally, media owners’ advertising revenues will grow by +9.2% this year to nearly $828 billion i.e. 32% above the pre-COVID level of 2019. MAGNA was always expecting the global advertising market to slow down significantly in 2022 following the unprecedented levels of growth observed in 2021 (Global +23%, U.S. +26%) caused by a once-in-a-lifetime “planetary alignment” of factors: the V-shaped economic recovery and the marketing consequences of post-COVID lifestyles. Still, in its December 2021 update, MAGNA was expecting +12% for global, all-media advertising revenues in 2022. The reduction of our forecast from +12% to +9% is due to two main headwinds: a global economic slowdown since 2Q (full-year real GDP growth +3.6% according to IMF compared to +4.9% six months ago), and the mounting restrictions to data-driven targeting affecting digital advertising sales (e.g. the impact Apple iOS changes have had on display and social ad formats).

Nevertheless +9% in 2022 would remain above pre-COVID growth rates (average 2015-2019: +7%). The economic slowdown will really start to affect ad markets in 2Q and 3Q and MAGNA anticipates lower growth over the period 2Q-4Q, as well as throughout 2023. Nevertheless, the full-year 2022 forecast downgrade would have been much steeper if not for a stronger-than-expected first quarter recorded in most markets (+14% in the U.S.). Growth expectations would also be lower if not for the strong cyclical factors of 2022: the U.S. mid-term election (bringing almost $7 billion to local TV stations and digital media), and two global sports events: the Beijing Winter Olympics and FIFA World Cup (Qatar, November). Without cyclical ad dollars, television revenue growth would be below +2% instead of growing by +4% this year.

Offsetting the effect of a weaker economic environment, organic drivers continue to fuel marketing activity and advertising spending. Among these: the competition between brands to gain leadership in new, fast-growing product verticals driven by lifestyle or regulatory changes (e.g. sports betting, food apps, direct-to-consumer disrupters), and the growing adoption of digital advertising by both local businesses and consumer brands, often at the expense of “below-the-line” marketing channels. Most industry verticals are expected to stabilize or increase ad spend this year. Travel, Entertainment, Betting, and Technology are expected to grow the most, while Automotive and CPG/FMCG budgets may be under pressure due to supply chain and cost issues.

Around an average growth rate of +9%, MAGNA anticipates North America to grow the most (+11%) followed by LATAM (+10%), APAC (+8%) and EMEA (+7.5%).

The EMEA economy and ad markets will slow down more than other regions in 2022 because of the impact of the Ukraine war on trade and energy costs and energy supply (40% of natural gas consumed in Western Europe comes from Russia). Additional headwinds include supply chain issues and the slowdown in Chinese imports, hurting manufacturing industries, typically in Germany, or the food and luxury industries in France or Italy. In April 2022, the IMF published real GDP forecasts between +2% and +3% for most of Europe (with Spain and UK slightly higher), i.e., 1 to 2% below the IMF forecasts in October 2021, and significantly below the global average (estimated at +3.6% at the time). Finally, most European economies and ad markets are mature, with all consumer brands and many SMBs already using the full palette of advertising formats, including digital formats and programmatic technologies. Marketing activity and ad spending are therefore more vulnerable to economic slowdown than in emerging regions that are driven by organic growth in media usage and marketing usage. The U.S. ad market (40% of the global advertising revenues) will grow above average (+11% to $326 billion) as it is relatively insulated from the economic consequences of the Ukraine war and boosted by record political advertising. The second largest ad market, China (15% of global advertising revenues) will grow below average (+8%) due to endemic headwinds: stricter and less predictable regulatory environment for digital media giants, severe COVID lockdowns under the “zero COVID” policy. Among other top 15 advertising markets the strongest growth forecast comes from India (+15%) and South Korea (+11%) while Germany and Sweden (both +6%), and Italy (+3%), will suffer the most in the post-Ukraine economic environment.

OUTLOOK BY MEDIA: THE DIGITAL LANDING

Advertising revenues from traditional media owners (TV, radio, OOH, print, cinema) will grow by nearly +4% to $282 billion i.e. 94% of the pre-COVID market size (2019). Out-of-home will perform best with advertising revenues growing by +10% to $30 billion (already 93% of 2019 levels), followed by Audio and Television (both +4%) and Publishing (-3%). Without cyclical ad dollars, traditional media revenues would grow by +2.3% instead of +3.6% this year. Traditional media companies are deriving a growing percentage of their advertising revenues from digital formats: in some markets AVOD streaming and podcasting are already contributing to 10% of ad revenues in television, 20% in audio media, 50% in publishing.

Television continues to suffer from erosion of linear reach and viewing: -5% to -10% per year among adults under 50, -2% to -3%. This is however offset by three drivers: (1) growing AVOD revenues (+10% to +15% this year), (2) double-digit inflation in cost-per-thousand pricing so far this year, and (3) incremental ad spend around cyclical events (mid-terms and Winter Olympics in the US, FIFA World Cup). Without cyclical dollars, television ad sales would grow by +1.6% this year, instead of +3.9%.

OOH is expected to grow by double-digits for the second year (2021: +12%, 2022: +10%, following a -25% decline in 2020) which brings it close to the pre-COVID market levels. MAGNA anticipates OOH to complete the “COVID recovery” as early as this year in the U.S., although it will take one or two more years at a global level. The OOH medium benefits from the recovery of consumer spending, and a positive industry exposure (Entertainment, Betting, Travel). The OOH industry is also reaping the benefits of its investment in technology and innovation over the last ten years; as digital OOH units reach critical mass (25% of total OOH ad sales) and omnichannel programmatic platforms can now include connected OOH screens in cross-media campaigns, OOH can tap into new and more vertical opportunities (CPG, Pharma, Retail).

Revenues from digital advertising formats (search, social, video, banners, digital audio) will reach $534 billion this year (+13%). Digital formats now represent 65% of total advertising sales worldwide. Search will remain the largest advertising format ($265 billion), ahead of Social (+11% to $158 billion), while Digital Video formats will be the most dynamic (+16% to $68 billion). All the same long-term drivers of digital advertising spending growth are in place, with consumers streaming more, spending online via ecommerce channels, and engaging with more digital media while working from home. However, there are also new headwinds, including broader economic and inflationary pressure, as well as the impact of Apple’s iOS privacy changes and impending future data collection changes that are offsetting some of that organic strength. As a result, the mix of digital spending will shift slightly in 2022 and beyond, away from social media and towards keyword formats and other campaign strategies that can directly attribute advertising spending to sales.

Digital video will be the most dynamic format in 2022 (+16% to $68 billion), reflecting the continued shift of viewing away from linear TV and towards on-demand, addressable platforms (mobile devices and, increasingly, connected TV). Long-form VOD has been mostly subscription-centric for the first ten years, but as SVOD subscription are approaching saturation, big SVOD players like Disney+ and Netflix are considering introducing cheaper, ad-supported tiers, which would bring more ad budget into digital video looking forward. Search will remain robust (+15% to $265 billion) as consumers continue to spend online, and because keyword formats are insulated from data privacy headwinds. Social media advertising sales will strongly decelerate this year to the slowest pace on record: +11% to $158 billion. This abrupt slowdown reflects difficulties attributing social platform spending to consumer purchases outside the social network walled gardens. Social’s mild slowdown will persist until in-app social commerce products are rolled out to again provide social campaigns with perfect visibility on consumer purchases.

Programmatic technologies, and audience targeting in general, remains the growth engine of many digital formats; programmatic advertising will continue to evolve as the privacy landscape matures. Changes in the data landscape moves budget from one digital format to another rather than away from digital campaigns entirely. Despite digital advertising’s slowdown in 2022, digital (and digital OOH) is still growing faster than every other format, as data and targeting help brands provide a more impactful advertising experience for consumers.

WHY SOCIAL ADVERTISING IS SUDDENLY STRUGGLING

MAGNA was always expecting social media advertising to decelerate in 2022 following explosive growth in 2021 (+36%). In the December 2021 update, MAGNA was predicting +18% in 2022 (half the growth of 2021). In this update we downgrade the 2020 growth forecast by seven percentage points to +11% – i.e. more than any other ad format. This is because social ad formats are hit by a combination of headwinds, with the last two in the list below being endemic/specific to the social ad format.

• Client saturation. In advanced mature markets, the social media budgets of consumer brands have reached a scale where any further growth comes under more financial scrutiny and becomes more vulnerable to current or anticipated business outlook. In 2020-21, millions of small businesses kick-started social media marketing during and after COVID. This is still happening in 2022, but at a slower pace.

• Audience saturation. Reach and time spent with social apps are nearly saturated in all advanced markets (Western World, China), and advertising growth in 2021 was almost entirely driven by pricing rather than volume. The plateauing in usage and ad impressions is increasingly clear this year, and incumbent players have reported declines in some mature markets.

• Targeting Restrictions: Since Mid-2021 the new Apple policy allowed millions of social media app users to opt out from sharing their device IDs and therefore prevented them from being targeted based on their data. Furthermore, it was difficult to tell what products users exposed to social media campaigns were purchasing because of that advertising spending. The impact was gradual: it started to visibly affect attractiveness and ad sales around the end of 2021, particularly for Meta and Snap.

As a result, in a social media market that is growing by only +10% or less for the time being, the rise of Tiktok (already 10% market share in the U.S.) is an additional headwind for incumbent social platforms. Past a difficult 2022, when ad sales must compare with a 2021 year that was still mostly without targeting limitations, the market should stabilize or recover some strength. Additional privacy measures may come from Apple and Google in 2023 (nothing as detrimental as iOS14) but social media players will introduce other ways to become attractive again e.g. in-app social commerce, partnership with retail media networks etc.

APAC FORECAST: +8%

The Asia Pacific advertising economy will grow by +8% this year, following the 2021 rebound (+18%). In 2023, the Asia Pacific ad market will expand by +7%, slightly higher than the global average of +6% and in line with the pre-COVID long-term regional growth. Growth is powered by large markets such as China (+8% in 2022, +9% expected in 2023) and India (+15% in 2022, +16% expected in 2023). In 2023, APAC advertising revenues will increase by +7% to $273bn, 35% above the pre-COVID spending level, driven by digital advertising growth (+12%).

The experience of Asia Pacific with COVID throughout 2021 has been mixed. Many countries in Southeast Asia suffered their worst outbreaks in the last few months of 2021 into early 2022 (Thailand, Philippines, Vietnam, Indonesia), which have caused pullbacks on advertising activity. Vaccine rollouts are also mixed. China and Japan have vaccinated three quarters or more of their population, whereas India’s vaccination rate is lagging and only increasingly slowly. On the other hand the experience of COVID and a home-centric lifestyle have changed the consumer behavior towards more streaming, more Ecommerce, and more integration of digital platforms into day-to-day lives, driving digital advertising spending, much as it has in the US and Western Europe.

Asia Pacific advertising markets are also struggling with supply chain issues and inflation, much as many other parts of the world are. China has seen multiple lockdowns of major cities to date in 2022 as part of their zero- COVID policy, and as a result many goods that are exported from China as part of the production chain in APAC markets are lacking. Prices are up, squeezing consumer budgets, and this will have a negative impact on consumer activity in the second half of the year.

Linear advertising spending (Linear TV, Print, Radio, OOH) will grow by +2% in APAC this year. In 2023, media owners’ linear advertising revenues will begin its decay at a -2% decline to represent 30% of total advertiser budgets. The growth of linear format spending in 2022 and 2023 will not come close to offsetting the huge declines during the peak of the pandemic in 2020. At the end of this year, linear advertising revenues will still be just 88% of the pre-COVID total. In fact, despite the bounce-back in spend observed in 2021 and expected this year, linear advertising revenues remain on a long-term declining trajectory to reach 23% of the total advertiser budgets (compared to 46% in 2019) by 2026. For that reason, linear advertising revenues may never again reach the pre-COVID total of $92bn in APAC. By 2026, linear advertising revenues will stand at $74bn.

Digital advertising spending, on the other hand, continues to grow this year and will continue to take shares from linear formats. Digital advertiser revenues are up +12% this year, and will grow by another +12% in 2023, to represent 71% of total advertiser budgets. This is up from just 54% of total budgets pre-COVID in 2019. This is also higher than pre-COVID expectations, as consumer behavior changes are positive for digital advertising spending trajectories. Increased Ecommerce spending, and increased video streaming, will both result in a higher share of attention of ad revenues going to digital formats.

Social media will slow in APAC to +13%, compared to +30% in 2021. This is similar to many other regions, however, it’s less because of Facebook slowdowns, and more because of similar data regulations in China. Many of the largest platforms in China are unsure what new products or services are going to be permitted in a harsher regulatory environment.

The APAC advertising market is concentrated around the two largest markets China and Japan, combining to represent 71% of total regional ad spend and ad revenues. In 2022, the strongest growth in APAC will come from India (+15%), Malaysia (+13%), Pakistan (+12%), Philippines (+12%), and Singapore (+11%). The slowest growth, on the other hand, will come from Hong Kong (+3%), Vietnam (+5%), Thailand (+5%), and Japan (+8%). No markets in APAC will decline in 2022, however.

In APAC (like everywhere else) digital advertising is powering total market growth. Digital advertising revenues are increasing by +12% this year and will increase by another +12% in 2023 to represent 71% of total advertiser budgets. Digital growth is primarily being driven from mobile advertising campaigns (+15% to nearly 82% of total digital budgets). By format, 2022’s growth will come from video (+14%), social (+13%), and search (+13%). In 2023, mobile advertising spending will again grow rapidly (+14% to 84% of total digital budgets), as will video (+15%), social media (+15%), and mobile devices (+14%). Smartphones are not just the dominant way that most consumers access the internet; in many APAC markets they are the only way most consumers access the internet. Because GDP per capita has only increased lately, many consumers skipped the desktop hardware generation and conduct their digital lives solely on their smartphones. Furthermore, in China, smartphones are more integrated into consumer lives than they are in almost every other market. Consumers regularly conduct not just their shopping and communications, but also their banking, insurance, and many work functions on their smartphones. By 2026, mobile advertising spending in APAC will represent 88% of total digital budgets.

In APAC, like in most global regions, lower funnel direct digital ad formats continue to perform better than upper funnel brand advertising-related formats. During COVID this was true because of the need to engage with consumers through Ecommerce. Following the crisis, these trends hold because digital consumption is even further integrated into consumer lives. Compared to pre-COVID totals, spending in 2023 on search (158% of pre- COVID total), and social (180% of pre-COVID total) will both be significantly higher than their pre-crisis counterparts. Banner display advertising, on the other hand (flat vs. pre-COVID total), will be struggling on a relative basis.

Television advertising spending will grow by +2% to reach $53.2bn, and it will start to decay by -3% in 2023 to reach 20% of total advertiser budgets. By the end of the year, television spending will represent just 94% of the 2019 pre-COVID total. Furthermore, linear television budgets will continue to shrink, and by 2026, they will represent just 23% of total advertising budgets in APAC. TV spending may get a small boost this year because of the Winter Olympics in Beijing. However, this is only stabilizing budgets for the year; television spending will resume its long-term decline starting in 2023, as consumer attention shifts away from linear television to digital media formats.

Print ad sales continue to shrink this year (-3%), and will shrink by -4% in 2023, representing just 5% of total advertiser budgets. Furthermore, spending on print will represent just 70% of the pre-COVID total in 2019 by the end of this year (2022). Print represents such a small portion of total spending, however (just 5% in APAC) that these declines do not have a huge impact on total regional growth. Many verticals or brands that might consider deeper print cuts have already cut print formats entirely from their media plans.

Radio ad sales will increase by +1% in 2023 to reach $4.9 billion, following 2022’s -3% decline. COVID has eroded the importance of radio in media plans because of fewer hours spent driving. As a result, radio will continue to decline slightly through 2026, shrinking to just under 2% of total budgets.

Out of home advertising will grow by +4% this year, and will grow by +3% in 2023 to represent 5% of total budgets. This will bring OOH spending back to 90% of the pre-COVID total. Cinema, however, fell significantly during COVID, bounced back by +24% in 2021, and is further expanding by +31% by the end of this year (2022). Growth will be +15% in 2023, but that still does not recover the losses from COVID.

One industry vertical that has been particularly hard-hit recently is the automotive vertical. COVID issues, combined with supply chain challenges particularly the shortage of semiconductor chips, has resulted in both decreased demand and lately significantly lower than usual production. APAC has one of the largest exposures to the auto vertical (9% of total ad spend pre-COVID). This is particularly strong in digital advertising, where automotive represents 13% of total ad spending. As a result, this will be a headwind to growth until automotive supply chain issues eases towards the end of the year.

Leigh Terry, CEO Mediabrands APAC, said: “While some markets continued to bear the effect of mixed Covid impacts through-out 2021, the APAC region advertising revenues have continued to rise to +35% above pre-COVID spending levels. Not surprisingly this has been largely driven by digital advertising, as digital consumption is even further integrated into consumer day-to-day lives. APAC consumption is already more significantly skewed towards Ecommerce than it is in western markets. Giants like Alibaba, JD.com, Rakuten, and Pinduoduo, have grown to the point where shopping online is just as large as shopping in person, vs. ecommerce sales at an average market share of 20% of total retail sales in the West.”

Gurpreet Singh, Managing Director MAGNA APAC, said: “Advertising spends in Asia Pacific are getting back on track after hitting negative growth in 2020 due to covid. Most of the APAC markets recovered the loss with double digit growth in 2021 over reduced 2020 base. This gap has largely been filled by massive growth in digital spends while spends on linear media have still not recovered back to pre-covid levels in most of the APAC markets. This year digital media is expected to hit the highest share of spends across the majority of APAC markets, including some of those markets which had been TV dominant until a couple of years back. Digital spends have grown much faster than all pre-covid predictions.”

CHINA

KEY FINDINGS

• Chinese media owners advertising revenues are growing by +8% this year, following the strongest performance the year prior (+16%). This will bring the total ad market size to CNY 810 billion ($126 billion), as China remains the second largest market globally behind the United States.

• Chinese GDP will increase this year by +4.4% on a real basis, down from 2021’s +8.1% performance.

• Digital ad formats are seeing an increase in spending by +11% to reach CNY 652 billion ($101 billion) in

2022. This represents a huge 81% of total advertising budgets.

• Linear advertising formats are shrinking by -3% this year, following 2021’s +5% growth. As linear advertising

formats lose some of the spending gained in 2021, linear advertising revenues remain 18% smaller than the pre-COVID total.

Chinese media owners advertising revenues are growing by +8% this year, following 2021’s strong growth (+16%). This will bring the total ad market size to CNY 810 billion ($126 billion), as China remains the second largest market globally behind the United States. This is extremely impressive considering that China was also one of the most resilient markets during the COVID crisis, but it is below global growth (+9%) for the second consecutive year. This is mostly because Chinese digital media owners have been struggling to grow revenues at the same rate as their global counterparts in 2021 due to new government regulations.

Chinese economic output is struggling so far this year due to COVID. Because China is maintaining its zero-COVID policy, any outbreaks result in lockdowns no matter how large the city. Omicron is more contagious than previous variants, and the zero-COVID lockdowns have not been as successful at fully containing outbreaks. China has had more than 1 million COVID cases, and both Shanghai and Beijing have been locked down for significant portions of the year. Shenzhen and Guangzhou have also experienced cuts, and advertisers have been hesitant to spend due to lower output as well as uncertainty as a result. The reductions have impacted digital, broadcast, and outdoor media formats.

Chinese GDP will increase this year by +4.4% on a real basis, down from 2021’s +8.1% performance. In this environment, digital ad formats are seeing an increase in spending by +11% to reach CNY 652 billion ($101 billion) in 2022. This represents 81% of total advertising budgets, the second highest globally behind only the UK. Most of the growth is driven by advertising spending on video ad formats, which will increase by +13% to reach CNY 118 billion and represents 18% of total digital ad spending.

By format, Mobile is, by far, the largest segment, and represents 88% of total digital budgets in China. Search advertising spending will increase by +12% this year, driven by both core search engines and Ecommerce platforms. Because in China, the five digital media giants (Alibaba, Tencent, Baidu, Sina, and Sohu) together control more than 75% of total digital advertising revenues, digital growth trends in line with their performance. Digital advertising has slowed of late, however, because government regulations have cracked down on many aspects of the digital advertising ecosystem. Data collection regulations, new product regulations, as well as antitrust fines, have crimped the flexibility that big digital giants have. Furthermore, there is intense competition between different platforms, with the incumbent giants Baidu, Alibaba, and Tencent, increasingly competing with JD.com, Pinduoduo, and Bytedance.

Looking forward, MAGNA expects digital advertising to expand in 2023 (+12%) then spike downward at a gradual decline starting 2024 and beyond, as there is more uncertainty and incremental headwinds for Chinese digital advertising growth. Digital growth will be led by social media (+17% to reach 29% of digital budgets) and video (+15% to reach 19% of total digital budgets). Static banners will continue to decline by -4%, following this year’s -3% decline as they continue to lose share and favor with brands.

Linear advertising formats are shrinking by -3% this year, following 2021’s +5% growth. As linear advertising formats lose some of the spending gained in 2021, linear advertising revenues remain 18% smaller than the pre-COVID total. The television market is shrinking this year (-2%) compared to last year’s +3% growth, as it now represents 14% of total advertiser budgets. There was a boost in television spending from the Beijing Winter Olympics, which were held in February. However, the increased viewing for the Olympics was milder than expected, and isn’t sufficient to offset viewing trend declines in 2022. Looking forward to 2023, there will be a further decrease in TV spending by -3%, as consumption trends once again result in headwinds for TV spending. Print formats continue to decline (-11%) and now represent less than 1% of total budgets. Like most markets, budgets in China are concentrating around TV and digital spending. Radio advertising is shrinking by -10% this year. Finally, while cinema grew by a tremendous +253% in 2021, it is declining by -20% and will continue its negative growth until 2026.

In 2023, the Chinese market will grow by +9% to reach CNY 883bn ($137bn). Digital will drive the growth through the end of our forecast period. By 2026, digital advertising revenues will represent 88% of total brand budgets in China.

JAPAN

KEY FINDINGS

• Media owners’ linear advertising revenues (linear TV, radio, print, OOH) will grow by +3% in 2022 to 2.6 trillion yen ($24.3 billion), as TV (+4%), OOH (+3%) and radio (+1%) are all expected to experience stability or slow growth in ad revenues.

• Digital advertising are slowing down too, but still growing by +12% to reach 3.4 trillion yen ($30.6 billion) with robust growth in Search (+12%), Digital Video (+11%) and Social media (+14%).

• As digital spending offset the decrease in linear formats, total advertising sales (linear+digital) will increase by +7% to reach 6.0 trillion yen ($55 billion).

• The combination of global economic slowdown, relatively high COVID early this year, and slow recovery in consumer mobility, contribute to slow economic recovery (real GDP +2.4%) and slow inflation (+1%).

• Japan remains the third largest advertising market in the world and the second largest in Asia, behind China.

After shrinking by -5% in 2020 (linear -15, digital +9) during the early stages of the COVID crisis, advertising spending grew by 20% in 2021, driven by the economic stabilization (GDP +1.6%) and the Tokyo Olympics.

Japan was relatively spared by the Japan pandemic through 2020 and 2021, but the more contagious Omicron variant led the highest levels of COVID infections in the first months of 2022, peaking above 90,000 new cases per day in February. New cases have since declined to 15,000 a day and the situation is under control despite a relatively low level of vaccination (55%). Japan authorities have decided to reopen the country to foreign visitors in June but this comes with strict limitations. Domestic mobility has not fully recovered yet: according to Google data, “Transit Station” mobility was still -14% below “baseline” (pre-COVID levels) by early June, and Workplace mobility still 5% below baseline.

In April 2022 IMF reduced its real GDP growth forecast from 3.2% (October 2021 update) to just +2.4% following a sluggish post-COVID rebound in 2021 (+1.6%). This is below a global average of +3.6%. While the rest of the developed world is struggling with consumer inflation (CPI) between +5% and +10% this year, IMF anticipates only +1% inflation this year in Japan, following a deflation of -0.3% last year. Even the rise in commodities and energy costs doesn’t seem to be moving prices in a country that imports massive amounts of fossil energy since it reduced its nuclear power output. The Japanese industry continues to suffer from the shortage in semi-conductors and other components, hurting domestic production and exports. New car sales for instance, are down by -16% Jan-May compared to 2021, and May alone was down -18%.

In this economic outlook, MAGNA is anticipating many brands in the Automotive and CPG sector might freeze or reduce linear advertising spending in 2022. Other verticals may grow moderately. Overall, media owners’ linear advertising revenues will grow by +3% in 2022 to reach 2.7 trillion yen (USD). TV (+4%), OOH (+3%) and radio (+1%) are all expected to experience stability or slow growth in ad revenues. Total linear advertising spending will remain below the 2019 level of nearly 2.9 trillion yen.

TV ad revenues will grow by +4% this year to 1.7 trillion yen ($24.3 billion) with a moderate CPM pricing increase (+2%) and extra spending expected before and during the FIFA world cup in November (Japan is qualified for the final tournament in Qatar). Television remains a central medium in Japan with robust viewing, 30% of total advertising sales and two thirds of traditional media ad sales. OOH ad sales will grow by +3% to 420 billion yens ($3.8 billion). Inhibited by the slow economy and the slow recovery in consumer mobility, the OOH market stabilizes but remains 20% smaller than pre-COVID (530 billion yen) after shrinking by -19% in 2020 and again -5% in 2021 (while most other markets were recovering).

Digital advertising are slowing down too, but still growing by +12% to reach 3.4 trillion yen (USD) with robust growth in Search (+12%), Digital Video (+11%) and Social media (+14%). Digital advertising is relatively under- developed in Japan with a market share of 56% compared to a global average of 65%. Japan however is less exposed than Western markets to data headwinds caused by privacy regulation, but it’s affected by the opt-in policy of IOS, as Apple devices account for 40% to 50% of smartphone sales.

AUSTRALIA

KEY FINDINGS

• Australia’s advertising market will grow by +10% this year to reach AUD 22.8bn ($17.1bn), driven by its economic growth of +4.2% (real GDP).

• Digital advertising spending will grow by +13% this year to reach AUD 16.6bn. This represents 73% of total ad spending.

• Linear advertising formats are growing by +4% this year to reach AUD 6.1bn. This follows 2021’s +12% growth for linear advertising sales, which represent 93% of the pre-COVID linear ad spending total.

• Looking forward to 2023, Australia’s advertising economy will grow by +5% to reach AUD 23.8bn ($17.9bn), with digital advertising again leading the way (+7%).

Australia’s advertising market will grow by +10% this year to reach AUD 22.8bn ($17.1bn). GDP will continue its growth by +4.2% this year on a real basis, following a very strong economic rebound in 2021 of +4.7%. Most of Australia’s population is now vaccinated against COVID (more than 95% of the 16+ population), which is another reason why the surge in COVID cases the past year has not led to a significant slowdown in ad spending. Mobility is returning to normal levels.

In this environment, digital advertising spending will grow by +13% this year to reach AUD 16.6bn. This represents 73% of total ad spending. This is behind only the United Kingdom, China, Canada, Taiwan, and Sweden, for highest share of digital advertising budgets as a percent of total ad spending. Digital growth in Australia (like in much of the world) is significantly stronger this year than it has been historically, and significantly stronger than expectations. Growth is led by mobile advertising spending, which will increase by +17% to AUD 11.8bn. By format, social media (+17%), video (+15%), and search (+12) are leading the way.

Linear advertising formats are growing by +4% this year to reach AUD 6.1bn. This follows 2021’s +12% growth for linear advertising sales, which represent 93% of the pre-COVID linear ad spending total. However, given that television is expected to continue eroding in 2023 and beyond, and print continues its long decline, linear ad spend will never reach the pre-COVID highs in Australia. Television spending will grow by +3% this year, and is regaining all the lost revenues during the pandemic. However, erosion will begin again in 2023 as viewing shifts away from television to digital formats. Australia didn’t quality for the World Cup directly, but they did quality for a play-in spot against UAE. In addition, there are other sporting events in 2022 that will boost TV spending, such as the ICC Men’s T20 Cricket World Cup in October and November that will be hosted in Australia. In addition, the Rugby World Cup Sevens will take place in Cape Town in September, which is always of interest in Australia. This will provide a boost to offset organic viewing declines in TV viewing.

Other linear formats are also expanding this year (radio +3% to AUD 1bn, out of home +15% to AUD 801 million), but print will continue its decline (-4% to AUD 711 million). None of the other linear formats regained its pre- COVID total, however. It will take three more years for OOH to grow back to pre-COVID totals (in 2025) and four years for radio (2026).

Looking forward to 2023, Australia’s advertising economy will grow by +5% to reach AUD 23.8bn ($17.9bn), with digital advertising again leading the way (+7%). While this is not nearly as strong as this year in 2022, it represents 2/3 as much incremental digital ad spending. The growth comparison is just more difficult as it is up against the tremendous performance from 2021 and this year rather than the extremely weak performance of 2020.

INDIA

KEY FINDINGS

• In 2021, the Indian ad market bounced back by +22.5% to reach ₹737 Billion ($10 billion) equalling 2019 revenues, after contracting -18.3% in 2020 due to the COVID outbreak.

• In 2022, the advertising market is expected to expand by +15% to reach ₹848 billion ($11.5 billion).

• India will be the fastest-growing market in the top 15 ad markets this year and next, and remains the 12th largest market globally.

• Digital Media to become the largest media with a market share of 40% ahead of Television (36%).

• In the next five years, linear ad spend will expand by +10% per year and Digital spending by +22% as India grows to the 8th rank globally.

Economic activity (real GDP) is poised to grow by another +8.1% in 2022, after expanding by +8.9% in 2021. The Indian economy, already the sixth largest in the world, is set to surpass the UK in 2023 and become the fourth largest economy in the next five years, surpassing Germany. Toppling first-world nations and being in the centrifuge of change will pivot India to the next level of growth, although behind several fundamental parameters like per capita income, social security etc.

India is a trade deficit market as it typically imports far more than it exports, even before COVID. Any impact on prices like it is on fuel and key commodities due to any kind of external disturbance, will push the deficit further down. The lock downs imposed by China in major manufacturing hubs will hit output in industries which feeds into supply chain and the dependency of India on these will impact India’s domestic output. The pressure of Inflation is felt on input costs for CPG companies and profit margins are expected to narrow. To maintain their bottom line, CPG advertisers might resort to cost cuts and advertising will be one of them. As inflationary pressures kick in, the impact will also be on discretionary spending and this will affect Auto, durable categories. The expectation is slower/below average spending for these categories.

Consumer inflation is expected to remain elevated this year with the recovery of private consumption, war induced negative terms of trade being a net-importer country, and China’s zero-tolerance Covid-19 policy impacting supply. However, CPI inflation is expected to ease out from +6.1% in 2021 to +5.7% as Central bank moved towards tightening monetary policy but will continue to be seen above target most of this year.

In 2022, as covid-induced lift in advertising dissipates, media channels will compete for the same pool of advertising money that is increasingly under threat from looming inflation. Impact on ad spends will be across the board and consumer facing marketers will thread even more cautiously. Performance will gain importance over brand building. Digital with its inherent strength of performance will be the major contributor to the growth.

In this economic environment, MAGNA expects digital brands, both established and new B2C tech companies will grow higher than the average, while CPG and discretionary categories like Automotive and Durables will see much slower growth.

On a full-year basis, the advertising market is expected to expand by+15% to reach ₹848 billion ($11.5 billion) as ad spend should accelerate by +19%, after a relatively subdued first half (+9%). Indian Premier League (IPL) cricket will bring most of the incremental ad spend. IPL media rights are coming up for review with double the reserve price for the next five years in 2023. Festival spends and the FIFA World Cup will also boost ad spend in the second half.

On a full-year basis, television advertising will grow by +10%, print advertising by +9% and radio by +13% in 2022. SVOD and AVOD are developing rapidly and might accelerate further in 2023 as Disney+ (claiming already 50 million subscribers) plans to expand its ad supported multi-tier SVOD plans basis content segregation and Netflix may follow. Meanwhile local BVOD platforms are growing in audience and advertising sales as they are adding sports on top of TV drama and originals. The largest TV apps are MX player from Times Group (second largest app in unique users and mostly AVOD-based), SonyLIV who also broadcasts Sports (Cricket, Football, Tennis, WWE) and Voot which is part of the Viacom TV18 Network introducing sports this year.

OOH advertising will recover by +28% as consumer mobility finally recovers for good. Mobility fell by 20% (according to Google location data) in the aftermath of the first COVID lockdown, then recovered gradually but fell again in the Spring of 2021. Since then, all mobility indicators have been slowly recovering but it took till February to see transit “Station mobility” grow back to pre-COVID levels and till March 2022 for “Workplace”.

NOTES ON OTHER MARKETS

SOUTH KOREA

South Korea’s advertising revenues are growing by +10% to reach KRW 15.1 trillion ($13.2bn). Despite the rapid outbreak of coronavirus cases in 2021, consumers still continued to spend and advertisers deployed budgets regardless of the crisis. Now as the virus levels down and consumer mobility continues to increase, GDP expectations will increase by +2.5% on a real basis, slightly below expectations. Part of the reason that consumers have continued regular activity despite the increases in cases, is because Korea surpassed 70% of the adult population vaccinated against COVID and now sits at about 86% of the population.

In this environment, digital advertising revenues are growing by +17% to reach KRW 10.2 trillion ($8.9bn). Digital formats represent 68% of total ad budgets. Digital growth is led by mobile device spending, which will increase by +21% to represent 75% of total digital budgets. Growth by format is led by video (+20%), social (+17%), and search advertising (+17%). Digital growth was stable through the pandemic in Korea however is expected a slow gradual decline starting this year until 2026. Furthermore, because of the recovery in online consumer spending, brands have shifted their focus towards performance marketing.

On March 3, 2022, Korea’s central data privacy regulator, the Personal Information Protection Commission published guidelines for personal data processing. The regulation is similar to GDPR. The effect has been that brands have engaged more with performance marketing vs. before the guidelines were published. Even though in some instances the guidelines restrict data collection and define rules for tracking consent, it provides additional certainty for what is permitted and what is not in Korea. For that reason, many digital formats in Korea that leverage data are outperforming their global growth averages.

Linear advertising revenues currently sits at 0% growth to reach KRW 4.9tn ($4.3bn). Linear advertising in South Korea has been shrinking since 2015, and currently represents just 75% of that 2015 linear advertising high.

Television is falling by -2% and represents 19% of total budgets. Television spend will continue its erosion going forward. Print budgets fell by -5%, falling to 7% of total advertisers budgets. Korea is one of the 4 Asian nations to outright qualify for the World Cup, and that will also provide a tailwind to TV spending later in the year. That tailwind will not be enough to spur growth, but rather will mitigate declines.

Looking forward, advertising spending will increase by +5% in 2023, with linear advertising budgets expected to decline (-3%), and digital ad spending to grow by +10% to reach 70% of total budgets. Digital ad spending will continue to gain share, and by 2026, will represent 77% of total budgets in Korea.

INDONESIA

The Indonesian advertising market will grow by +10% this year, to reach IDR 133 trillion ($9.3 billion). GDP in Indonesia is expected to increase by +5.4% on a real basis in 2022, slightly lower than prior expectations. Ad spending remained strong this year and will continue its strong performance heading into 2023 (+7% growth expected).

In this environment, digital advertising spending will grow by +16% to represent 52% of total budgets. For the first time, digital advertising spending will surpass half of the total budgets this year. In 2023, digital advertising revenues will increase by +12% and represent 55% of total advertiser budgets. Digital spending is led by mobile device spending, which will increase by +22% and represents 70% of total digital advertising budgets. By format, growth in 2022 is being led by social media (+21%), video advertising (+18%), and search advertising (+16%). Digital advertising revenues will continue to outperform linear formats, and by 2026 digital spending will represent 62% of total advertiser budgets in Indonesia.

Linear advertising spend will grow by +3% to reach IDR 63.4tn ($4.4bn). Linear advertising spending is only 88% of its pre-COVID total. Television spending will increase (+4%), but print (-9%) continues to lose budgets. Out of home advertising will grow by +10% and has regained, and more, essentially all the spending it lost during the COVID crisis. Cinema advertising, however, remains significantly below its pre-COVID total, representing just 80% of prior budgets.

THAILAND

Media owners advertising revenues are increasing by +5% in Thailand in 2022 to reach THB 124.3bn ($3.9bn). This will leave the Thai market below its pre-COVID total of THB 131.3bn. The economy is expanding by +3.3% on a real GDP basis, following 2021’s +1.6% real GDP growth. Furthermore, as vaccinations are readily available throughout Thailand, still just about 73% of the population is vaccinated. Combined with the persistent reluctance of Western tourists to travel abroad already, this creates economic uncertainty and a headwind to advertising spending. Pre-COVID, tourism contributed to 20% of the Thailand economy.

In this environment, linear advertising revenues are growing by +3% and represent just 81% of their pre-COVID level. Linear advertising budgets represent the majority of spending in Thailand (72% of total budgets), and the delayed recovery from the COVID crisis for linear ad spending creates a significant drag on total market growth going forward. Television ad spend is stagnant (0%) and represents 53% of total advertising spending. Television spending is still short of the pre-COVID total. Because spending will continue to erode, TV will never reach its all- time high. Print spending is still declining, and is falling by -17% this year and represents just 3% of budgets. There are only a few core spending industries that still deploy budgets on print: real estate, finance, autos, and CPG. OOH spending is seeing a strong rebound of +20% this year as the economy recovers from the COVID outbreak in 2021.

Digital advertising spending will grow by +13% in 2022 and represents 28% of total budgets. Growth is led by mobile device spending, which will increase by +15% and represents 78% of total digital spending. By format, growth is led by social (+15%), search (+14%), and video (+13%).

Looking forward to 2023, ad spending will again grow modestly (+5%) to reach THB 131.0bn ($4.1bn) as Thailand returns to normalcy post pandemic.

HONG KONG

Advertising sales in Hong Kong are increasing by +3% in 2022 to reach HKD 31.0bn ($4.0bn). GDP will grow by +0.5% on a real basis, following 2021’s +6.4% real GDP growth. Many markets in APAC have struggled with new COVID outbreaks in the second half of 2021. Hong Kong, on the other hand, has maintained its COVID cases close to zero for essentially all of 2021, however outbreaks of new cases have emerged this year although ~78% of the population is vaccinated. For this reason, brands are experiencing decreased confidence to deploy budgets, especially as new quarantine regulations come into effect.

In this environment, linear advertising revenues are shrinking by -8% this year to reach HKD 15.2bn ($2.0bn). This represents 49% of total budgets and 82% of its pre-COVID total. Television spending is also declining by – 7%, losing about half of all the spend gained in 2021. Print this year is declining by -18%, following their +7% growth in 2021 and only represents 51% of the pre-COVID total.

Digital advertising revenues are growing by +16% and represent 51% of total budgets. Digital advertising revenues are led by mobile device spending, which will increase by +20% and represent 76% of total digital budgets. By format, digital growth is led by social media (+20%), search advertising (+18%), and video advertising (+16%). The digital video landscape in Hong Kong is extremely strong, and represents 43% of total digital spending, one of the highest totals globally.

Looking ahead to 2023, Hong Kong advertising spending will grow by +5% to reach HKD 32.7bn ($4.2bn). The advertising economy will also continue to reflect the new post-COVID normal. Brand marketing changed because of COVID, with higher demands on discounts and bonuses for linear media. Furthermore, there is more ad-hoc planning and last-minute campaign changes in reaction to market changes, and more efforts spent on contingency plans. Finally, not surprisingly, there are stronger Ecommerce and social commerce efforts from advertisers.

MALAYSIA

Media owners advertising revenues in Malaysia are increasing by +14% this year to reach MYR 6.1bn ($1.5bn). The economy will grow by +5.6% on a real GDP basis, following 2021’s +3.1% growth. While this is lower than prior expectations, brands spent anyway, especially on digital advertising formats. With more than 82% of the population now vaccinated, consumer behavior is returning to normal.

In this environment, linear advertising revenues are increasing by +6% to MYR 2.3bn ($545 million). Linear budgets remain at just 68% of their pre-COVID levels. Because linear ad spending will erode from here as consumers continue to shift to digital media formats, linear advertising revenues will never again approach their pre-COVID highs. TV spending, which increased by +1%, are now 92% of their pre-COVID total. Finally, with the economy returning to normal and consumer spending increasing, cinema screens have re-opened. Recovering from the fallout due to closed operations, cinema is showing a substantial growth this year of +330%. Finally, an increase in consumer behavior means that OOH spending will increase this year (+13%) and will continue to grow by +15% in 2023.

Digital advertising spending, on the other hand, will grow by +18% to reach 63% of total budgets. Digital advertising spending is being led by social media, which will increase by +25% and represents 47% of total digital budgets. By format, spending is led by mobile (+24%), display (+17%), and search (+14%). Digital advertising spending will continue to significantly outperform linear budgets, and by 2026, digital formats will represent 73% of total advertiser budgets.

Malaysia reopened its borders to all international visitors starting April 1st. This will provide a boost to the tourism, airlines, and hotel industries. In addition, Malaysian general elections, while not constitutionally required until mid-2023, have been rumored (a snap election) throughout the past few months. If there is a snap election that could also provide some incremental TV ad spending revenues.

In 2023, ad spending will grow by +6% to reach MYR 6.5bn ($1.6bn). GDP will continue to grow by +5%, and linear budgets will begin to decay in 2023 and beyond.

TAIWAN

Advertising sales are growing by +10% this year to reach TWD 108.8bn ($3.9bn). The Taiwanese economy will grow by +3.2% in 2022 on a real GDP basis and is expected to continue its growth by +2.9% in 2023. Taiwan has held COVID remarkably under control throughout the crisis, however is now experiencing a peak of cases (~80,000 new cases daily on average).

In this environment, linear advertising revenues are shrinking by -1% and represent just 27% of total ad budgets. This remains just 88% of the level of pre-COVID budgets, however linear ad revenues are expected to gradually decrease, never again reaching the pre-COVID high. Television advertising spending is slightly growing (+1%), but print (-22%) and radio (-1%) continue to suffer. Short term behavior is changing while COVID remains a threat, as well as long term consumer habits which have shifted towards online consumption, will be a permanent headwind to these formats. Out of home spending will increase by +3% however MAGNA estimates a decline in spending starting 2023 through 2026.

Digital advertising formats are growing by +14% and now represent 73% of total advertising budgets. Digital spending is driven by spending on mobile devices, which is rising by +16% and represents the majority (85%) of total digital spending. By format, growth is led by search spending (+15%), social media (+14%), and video advertising (+10%). Looking forward, digital spending will continue to outperform linear advertising formats, and by 2026 digital formats will represent 83% of total budgets.

Because of the spike in COVID cases in Taiwan, the government is still suggesting that people work from home and keep social distancing to prevent severe outbreaks. That’s one of the drivers of OOH growth slowing significantly. In addition, this will have some headwinds on entertainment and general service expenses. If the outbreak doesn’t follow the standard Omicron length (brief spike, quick abatement), then 2H advertising spending will be even weaker than these expectations. However, more time spent at home does generally boost TV viewing (as it did in other markets during the heights of COVID quarantines).

PHILIPPINES

Advertising spending in the Philippines will increase by +12% this year, to reach PHP 143.5bn ($2.9bn). Real GDP will increase by +6.5% this year, slightly higher than prior expectations of +5.6%. While only 1/3 of the population was vaccinated at the end of 2021, ~62% is now vaccinated, allowing more mobility and further growth in 2022.

In this environment, linear advertising revenues are increasing by +12%. Television budgets are increasing by +9% to PHP 76bn ($1.5bn). Television spending is advancing past the pre-COVID spending total. Print will grow by a small amount (+3%), following a growth of +8% in 2021. Print budgets remain hugely below their pre-COVID total and now represent less than 1% of total advertiser budgets. Out of home spending will grow by +22% and MAGNA predicts out of home to reach pre-COVID totals by 2023. Finally, cinema revenues are growing this year by +32%.

Digital advertising spending will grow by +17% and now represent nearly one quarter of total budgets. By 2026, digital advertising will represent 41% of total budgets.

SINGAPORE

Singapore’s advertising sales are increasing by +11% to reach SGD 2.7bn ($2.0bn). Singapore’s economy will increase by +4.0% on a real GDP basis, While Singapore experienced their worst COVID outbreak in 2021, the government has transitioned back to a semblance of normality. It helps that 93% of the population in Singapore is vaccinated, one of the highest rates in the world. As a result, the government has switched from a ‘zero COVID’ policy to a policy of living with COVID. Consumer behavior has returned to normal, and brands are deploying the dollars they cut during the pandemic to take advantage of the new reality. As of April, group size limits for gatherings and safe distancing requirements have been removed in Singapore, and Singapore has also dropped COVID test requirements for fully vaccinated travelers. Mask wearing is still required in a few select situations, but the environment is close to pre-pandemic behavior.

In this environment, linear advertising revenues are increasing by +8% and represent 60% of total budgets. This follows the +15% rebound in 2021, one of the best performances for linear advertising revenues since 2010. Linear advertising revenues are expected to surpass the pre-COVID total this year to SGD 1.8bn ($1.2bn). However, because linear advertising revenues are expected to continue to decline starting in 2023, they will never again reach this year’s number. Television advertising spending will grow by +8% and represent 31% of total budgets. Out of home format spending will grow by +17%, following their strong growth of +47% in 2021.

Key drivers of TV spending were brands in telecom, real estate, auto, travel, insurance, retail and pharma. Furthermore, consumer confidence is recovering in Singapore as the recent wave of COVID cases recedes, and that combined with declining unemployment has caused a general tailwind to spending in 2022 for linear media formats. Supply chain concerns and inflation has pushed some price-sensitive spending out of expensive TV formats and into more efficient media formats. The government in Singapore is trying to combat general economic inflation by allowing the currency to appreciate against the currency of key trading partners to allow for less expensive imports, but ultimately consumer purchasing power will still be impacted.

Digital advertising revenues will grow by +17% and represent 40% of total advertiser budgets in Singapore. Spending is being led by social media advertising, which will increase by +21% and represent 39% of total digital budgets. By format, growth is led by mobile (+20%), search (+17%), and video (+13%). Digital advertising will continue to outperform linear advertising formats, and by 2026 they will represent 54% of total advertiser budgets.

NEW ZEALAND

The advertising economy in New Zealand will increase by 8% in 2022 to reach NZD 3.5 billion ($2.5 billion). The economy in New Zealand will grow by +2.7% on a real basis in 2022, leveling out from the rebound in 2021 (+5.6%).

In this environment, linear advertising revenues are increasing by +2%. Linear advertising spending this year is at 90% of its pre-COVID total. Television revenues are increasing by +2% and is expected to continue its decline at -3-5% from 2023 to 2026. Print is shrinking by -1%, however out of home spending will grow (+13%), reaching about ~90% of its pre-COVID total. MAGNA predicts out of home to surpass pre-COVID measures by 2023. TV pricing continues to increase as demand is significantly outstripping supply. Some price-sensitive brands have started to shift away from linear TV, but not yet to a significant degree.

Digital advertising revenues are growing by 13% to reach NZD 2.2bn ($1.5bn). Campaigns on mobile devices are leading ad spending, which will grow by +17% and represents 70% of total digital budgets. By format, growth is being led by video (+15%), search (+15), and social (+14%). Looking forward, digital will continue to take share compared to linear advertising formats, and by 2026 digital budgets will represent 70% of total advertising budgets.

Looking forward to 2023, there will be a general election as well as the Rugby World Cup held in France.

VIETNAM

Advertising revenues in Vietnam are increasing by +5% this year, faster than prior expectations. This will bring the market to VND 32.8 trillion ($1.5 billion). The economy in Vietnam will increase by +6.0% on a real GDP basis.

Linear advertising revenues are shrinking by -4%, with television also shrinking by -4%. Linear advertising formats represent 62% of total budgets. Television spending is decreasing by -4% to 58% of budgets. TV advertising revenues are still a huge portion of overall ad budgets in Vietnam. Digital advertising revenues are increasing by +22% to reach 38% of total advertiser budgets. Digital spending is led by social media advertising, which will increase by +36% and represents 48% of total digital advertising budgets. By format, mobile (+30%), video (+15%), and search (+13%) are leading growth.

PAKISTAN

Pakistan’s economic recovery is expected to continue in 2022, with real GDP forecast to grow by +4.0% according to the latest IMF report (April 2022) following growth of +5.6% in 2021. With oil and power sectors affecting global stability, Pakistan’s consumer price inflation is rising by 11.2%, up from 8.9% in 2021. IMF forecast estimates further growth of inflation in the double-digits in 2023 of +10.5%. A replacement of a new Pakistani government is bringing uncertainty within the country, however the IMF report predicts Pakistan to continue its growth in 2023 by +16.0% (nominal GDP).

In this context, linear net advertising revenues are growing by +7% in 2022 from +7% growth in 2021, with OOH (+13%) and cinema (+13%) seeing the strongest growth as the economy reopens post COVID. Print will continue to stagnate, -1%, while both television and radio will see a modest increase of +7%. Overall, MAGNA anticipates total linear revenues will reach nearly $491 million by the end of 2022, above the pre-COVID total of $460 million.

Digital ad formats will experience another year of strong growth following a +41% increase in 2021, with revenues rising +30% to reach $175 million. Significant increases from digital video (+43%) will continue to drive growth in 2022, while mobile (+37%) will surpass search (+31%) to lead as the second driving force within Pakistan’s digital ad formats. Digital media remains relatively underdeveloped in Pakistan, accounting for less than 30% of total ad dollars (APAC average: 51%; India: 40%) but growing rapidly. Over the next five years MAGNA anticipates a digital CAGR of +26%. Over 70% of digital ad dollars currently go towards mobile formats; this share is expected to increase to 86% by 2026.

SRI LANKA

The Sri Lankan advertising market will grow by 10% in 2021 amid the new Omicron COVID-19 variant and political and economic turmoil and is expected to grow by +16% in 2023. Further growth in 2023 will be driven primarily by digital formats (+26%).

On the macroeconomic side, real GDP is expected to grow by +2.6% this year, slightly below the previous IMF forecast (October 2021) of +3.3%. Consumer price inflation is accelerating up to +17.6% due to global inflation spikes and will grow by another +12.9% in 2023.

However, economic stability in Sri Lanka is facing disruption, as recent unfortunate global events weigh heavily on the country and political turmoil worsens. Supply shortages for everyday essentials from food to medicine have caused social unrest as inflation spikes are creating a lack in consumer confidence. In addition, Sri Lanka’s prime minister has recently resigned and threats of an economic recession impose downside risks for the country’s economic outlook.

The advertising market will grow by +10%, a slight decrease from 2021 (+14%). As we see across APAC, digital is the backbone of growth, with all digital formats expected to see another year of double-digit growth: video +52%, social +25%, search +21%, and display +18%. In total, digital advertising revenues will reach $131 million, or a 37% market share. Linear formats will also see some growth this year, thoughon a smaller scale. Television (+3%) and radio (+5%), and OOH (+13%) will see the strongest growth while print will decline slightly (-5%). 2023 will bring continued recovery for most linear ad formats, with the exception of print, but over the long term we anticipate digital will continue to gain market share at the expense of linear media channels.

MAGNA is a leading global media investment and intelligence company. The MAGNA research is media centric. It monitors net media owners advertising revenues based on a bottom- up analysis of financial reports and data from media trade organizations; other ad market studies are based on tracking ad insertions or consolidating agency billings.